We are Market Timing Specialists and Wealth Management Experts. Join us today and experience the difference.

Contact:

Subramanyam C

Phone: 9686539973

Email:

No matter where you are in the country, we are dedicated to offering you the best services for your mutual funds and wealth management needs. We can assist you every day from 9.30 AM to 10 PM. There are no service charges for mutual funds and financial planning.

For free equity delivery and the lowest brokerage charges in India, we have partnered with Angelone.in. This platform can be used for various investments, including equity, mutual funds, sovereign gold bonds, and fixed deposits.

If a lumpsum investment is made without knowing the market timing, the impact on the investment returns from Dec 2007 to Dec 2022 is explained in the pdf: click here

If an investment is made through the Systematic Investment Plan (SIP) during the same period is explained in this pdf: click here

Prepare the following documents to open your account: 1. Aadhaar 2. PAN 3. Signed and canceled cheque leaf, 4. 10 seconds of self video

How do we differentiate ourselves from other mutual fund distributors?

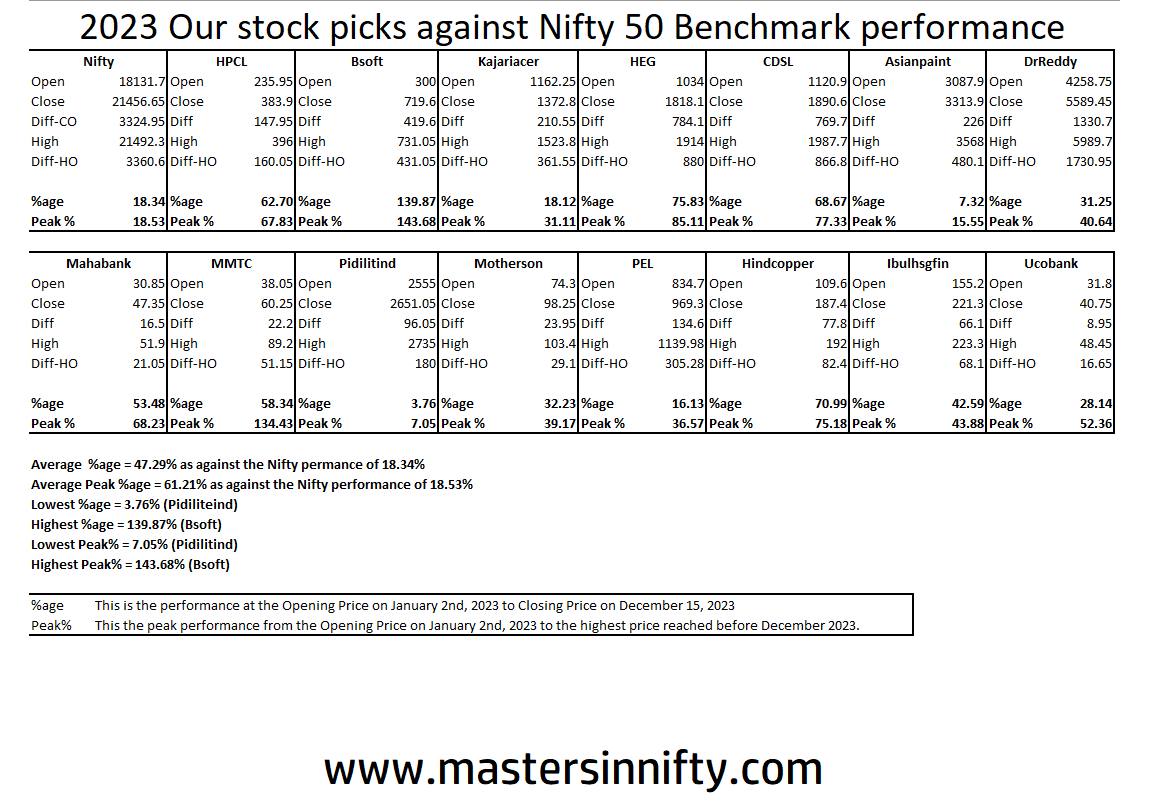

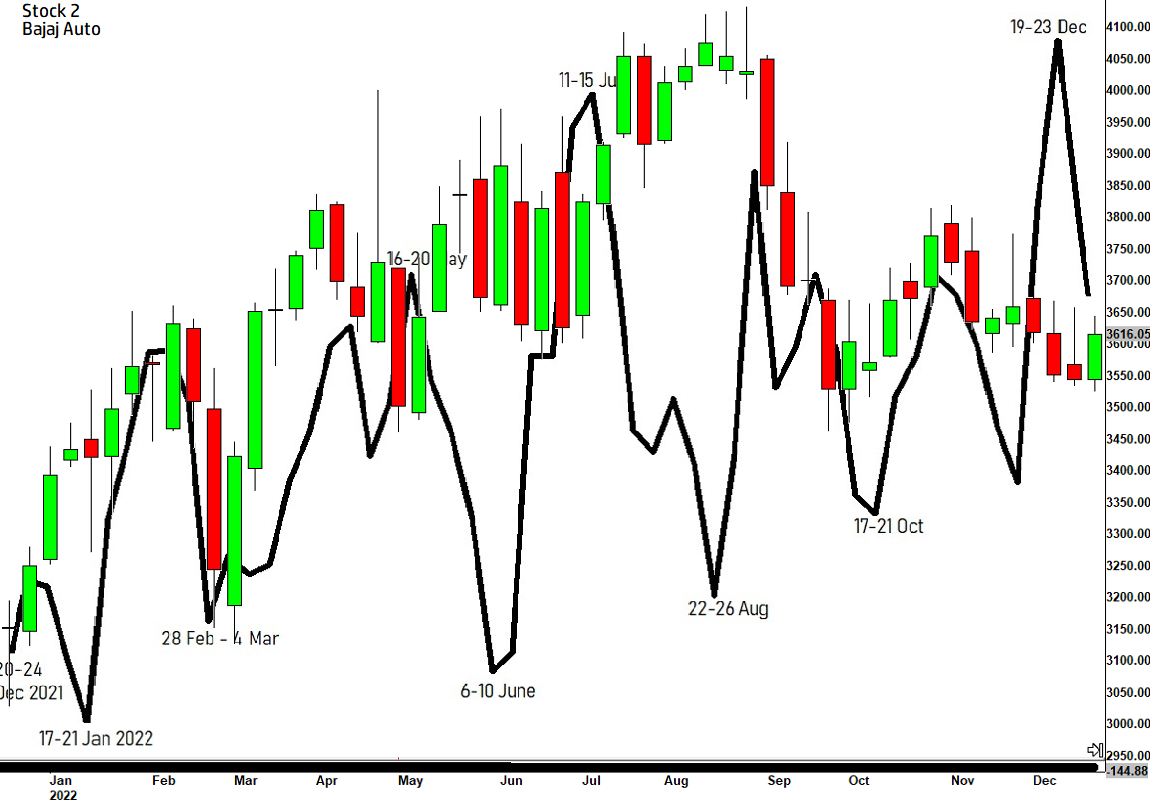

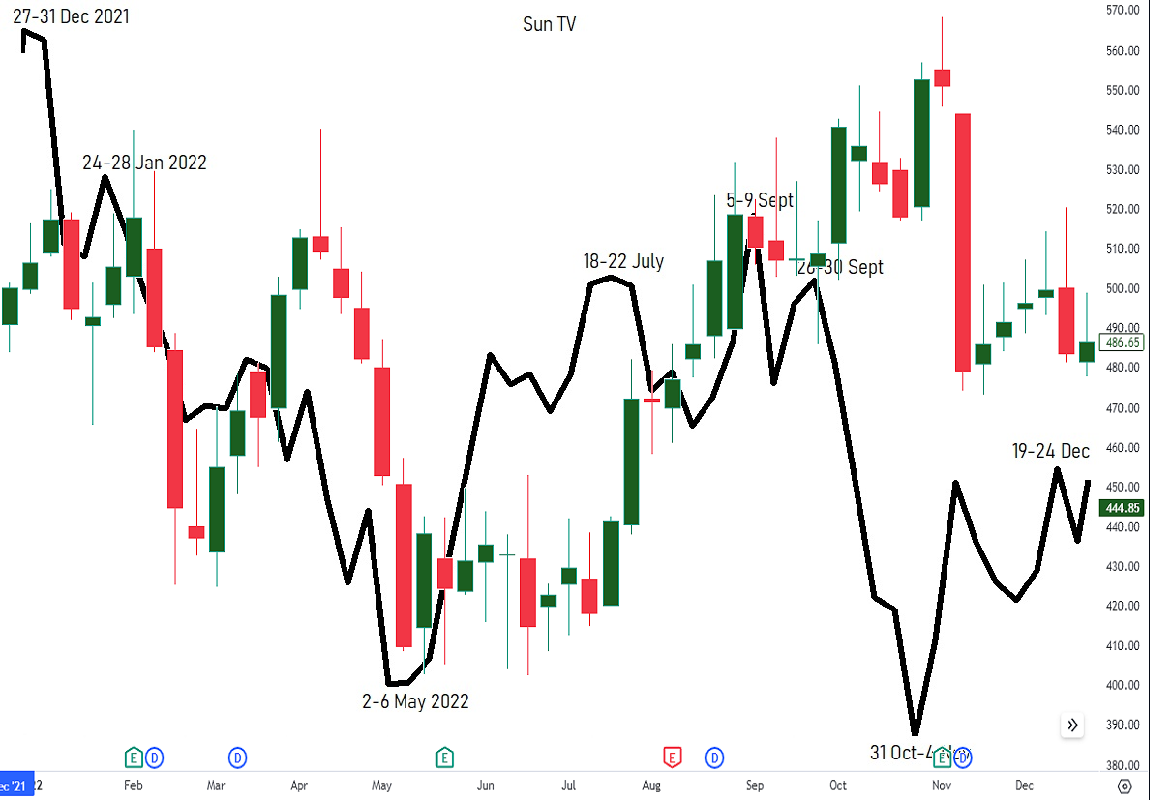

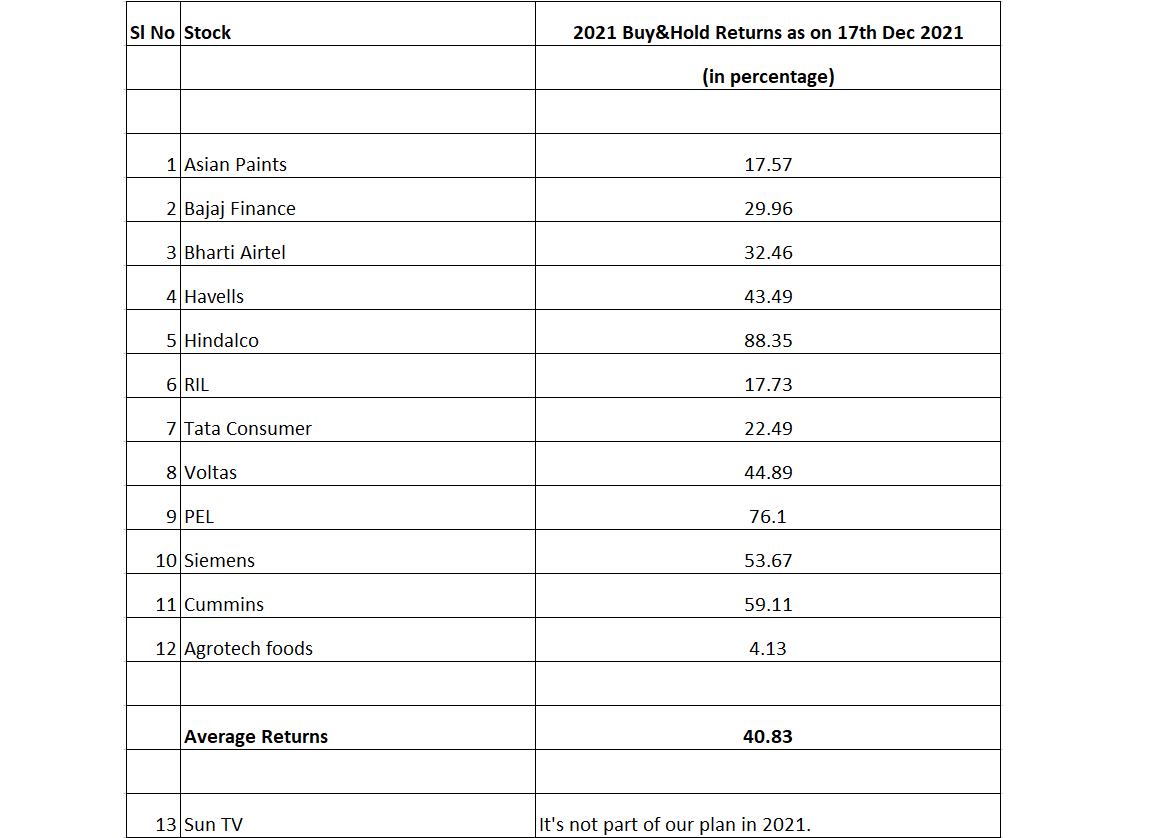

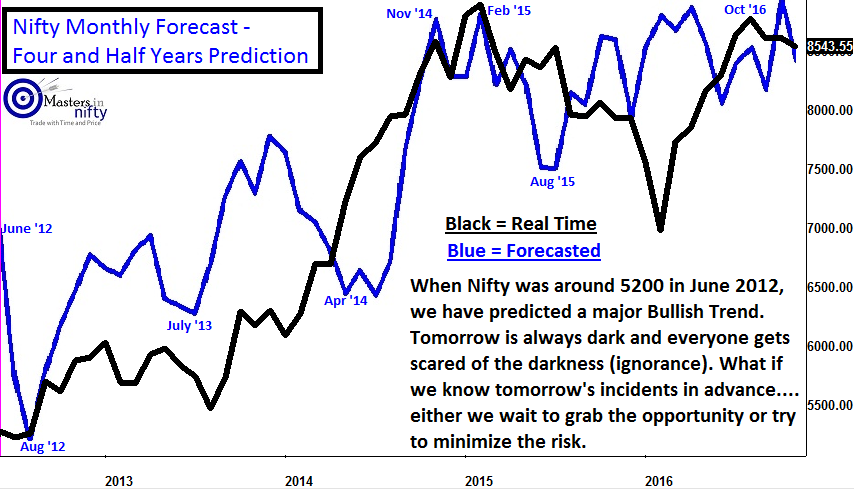

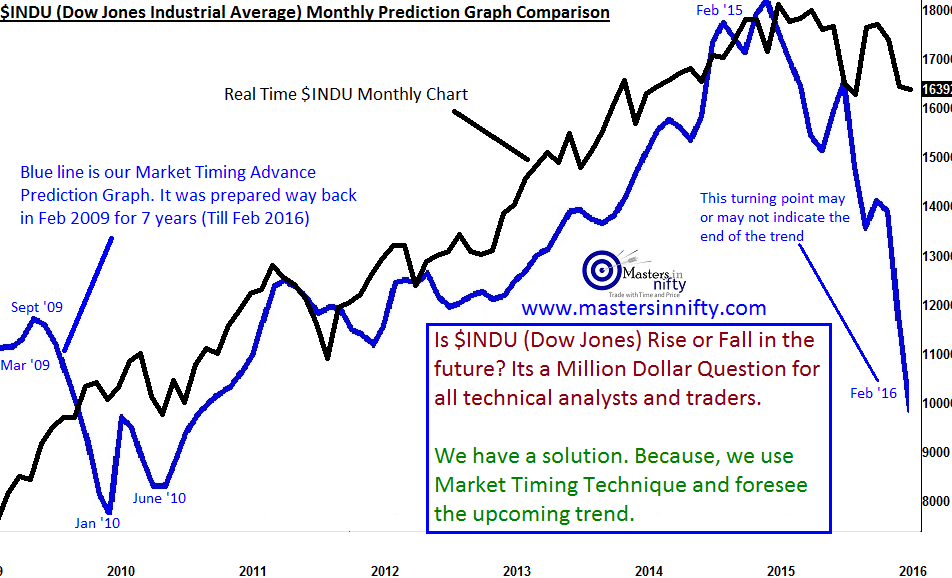

With 27 years of experience in mutual funds, wealth management, equity/stock research, and investments, life insurance solutions, sovereign gold bonds, and company fixed deposits, we offer a distinct edge over other mutual fund distributors. Our expertise lies in precisely identifying market cycles and turning points. This allows us to advise our clients on optimal entry and exit points for equity funds, thereby maximizing fund performance.

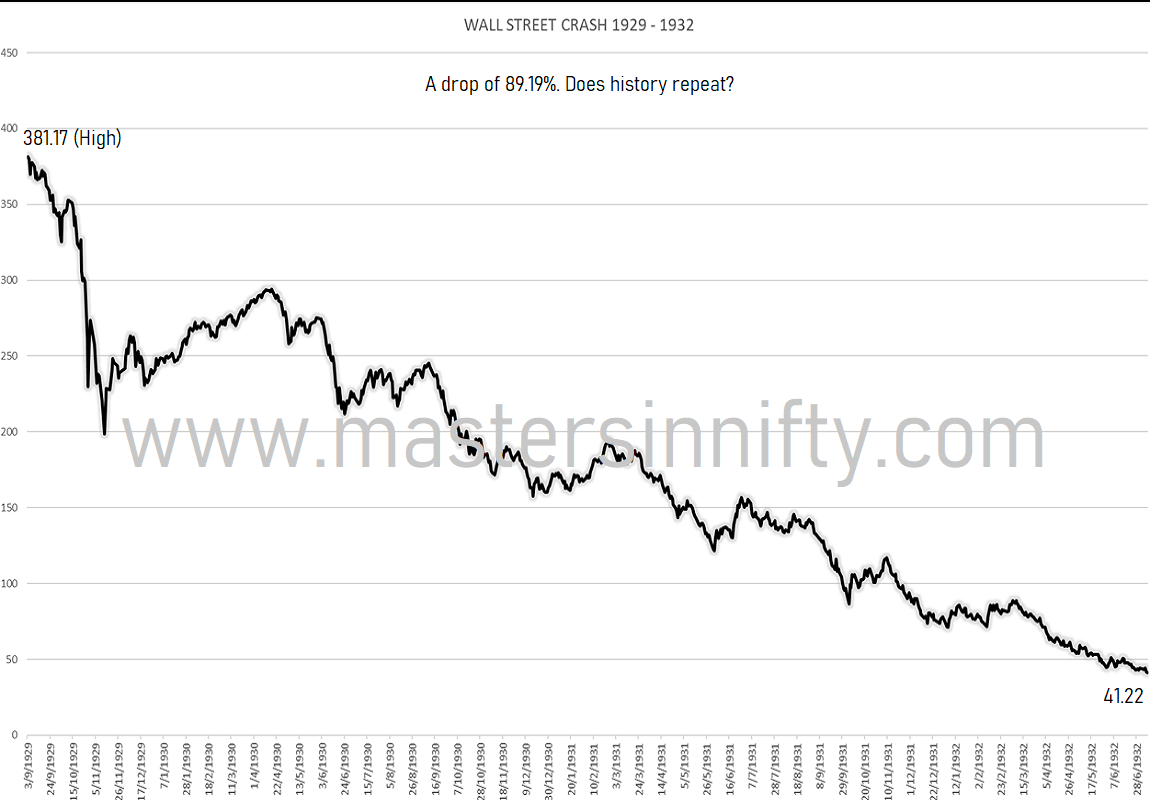

Understanding the trajectory of market movements provides valuable insights for optimizing portfolio balance, resulting in superior performance over the medium to long term. Investing without understanding market trends can lead to significant capital depletion during downturns, requiring extended recovery periods for capital appreciation. Our expertise in market timing is essential for achieving optimal performance in both equity mutual funds and direct equity investments.

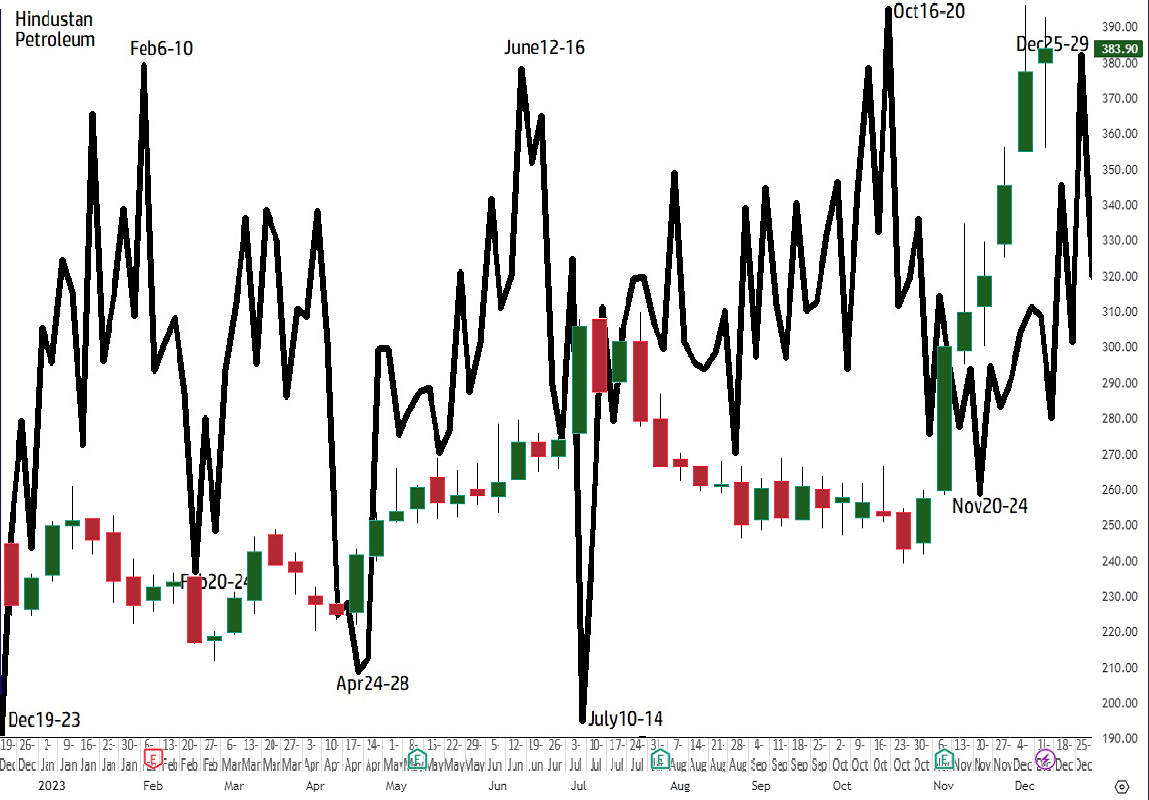

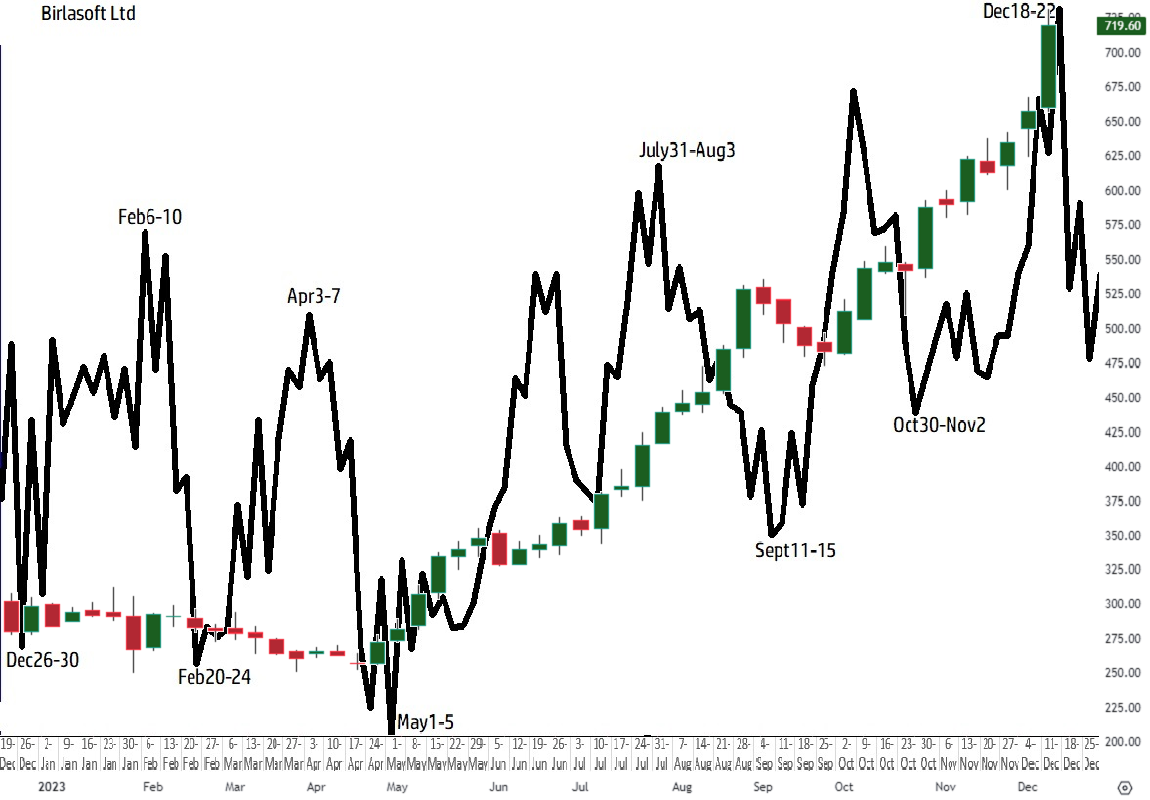

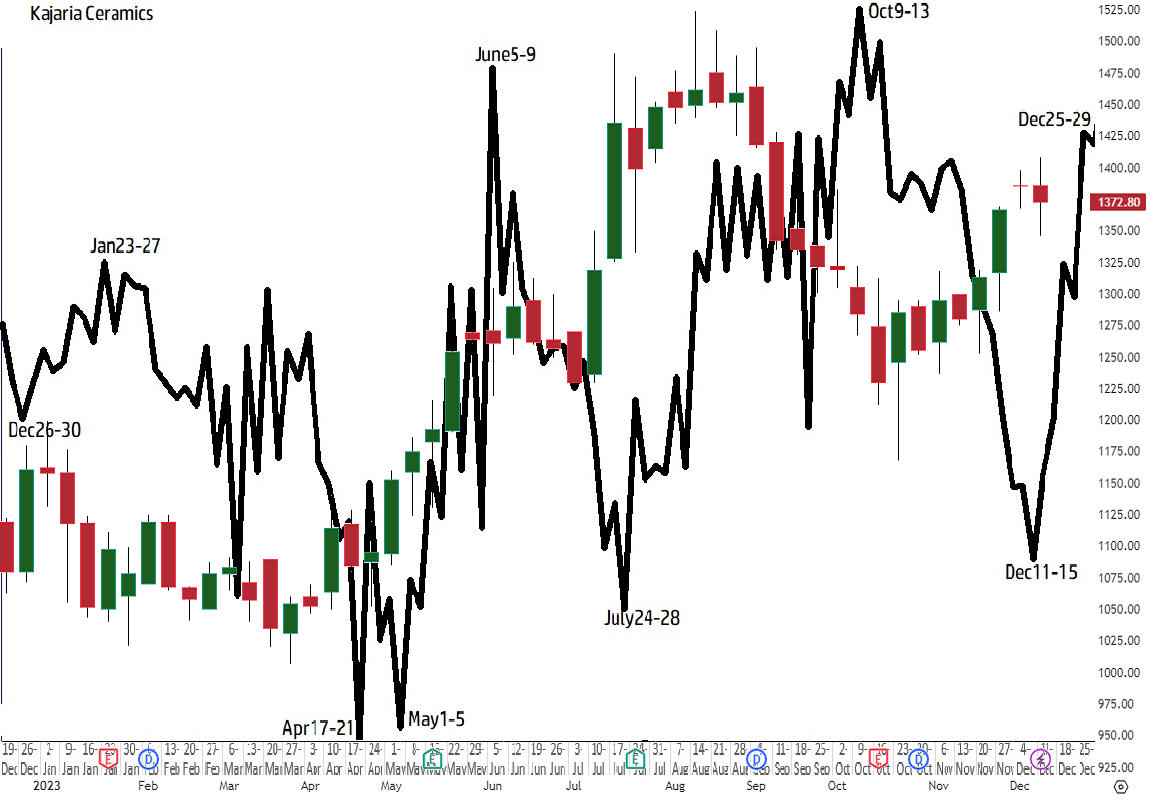

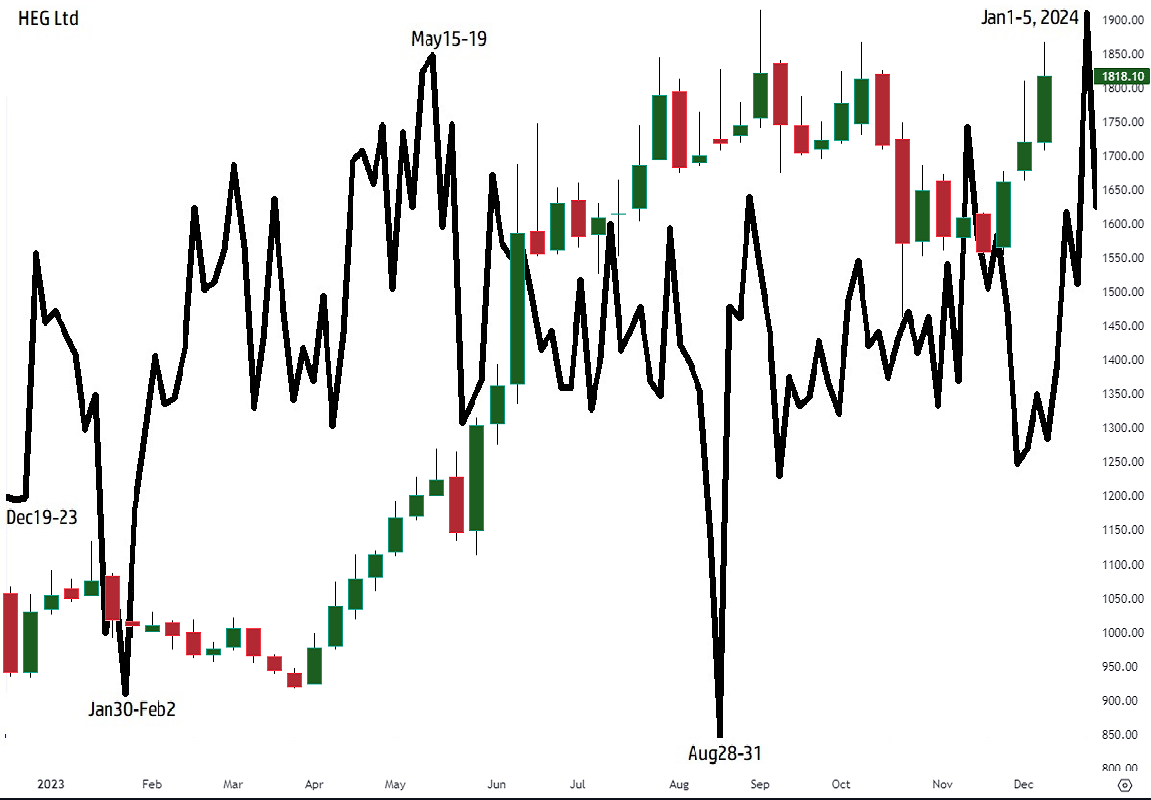

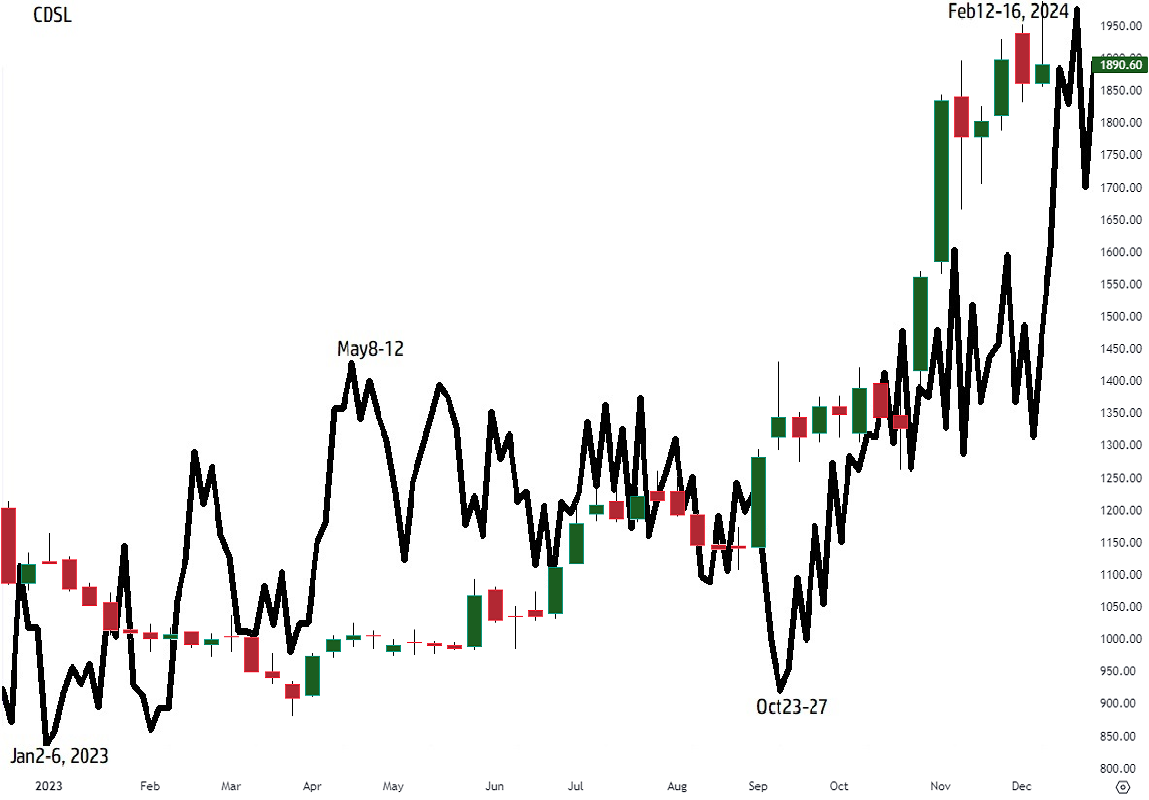

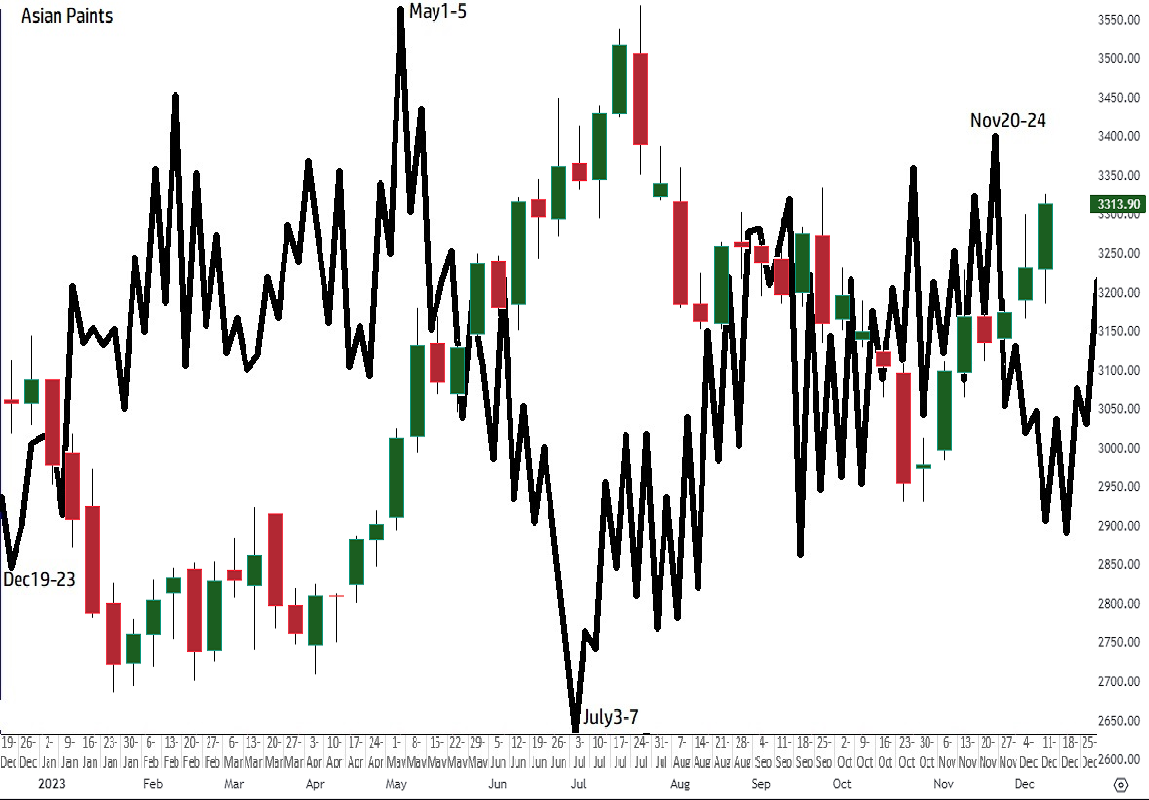

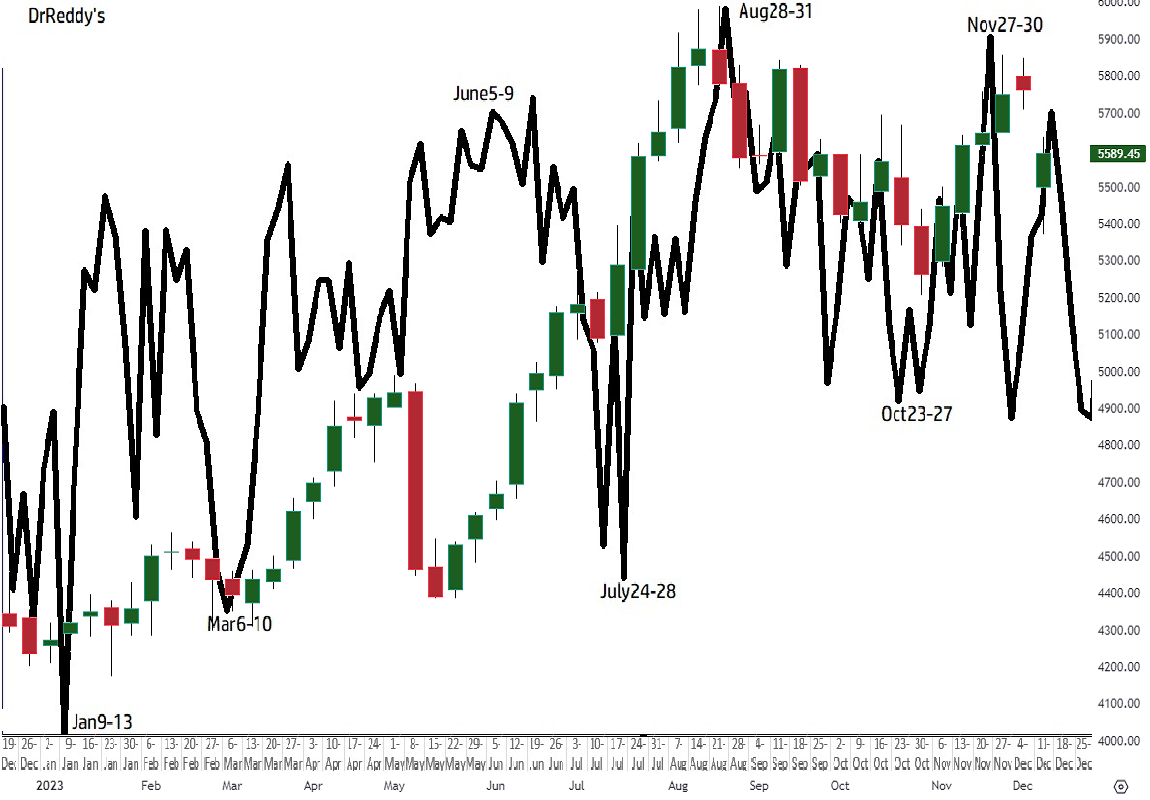

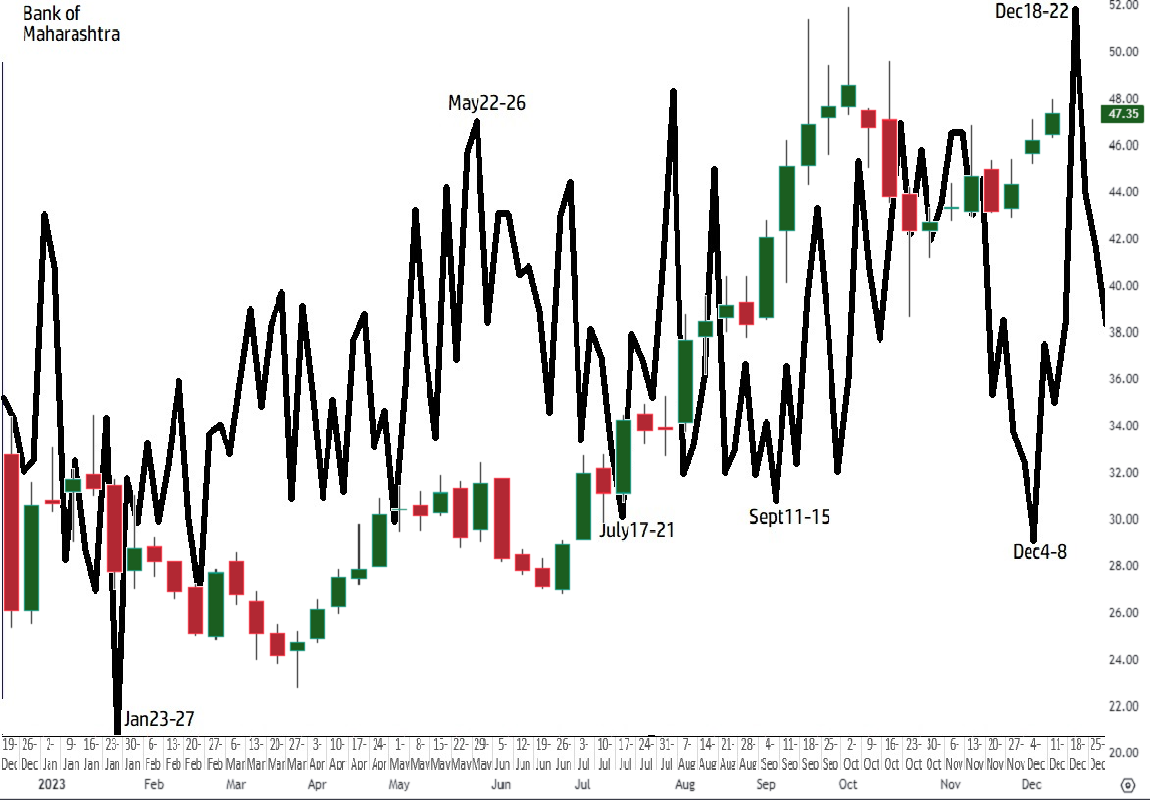

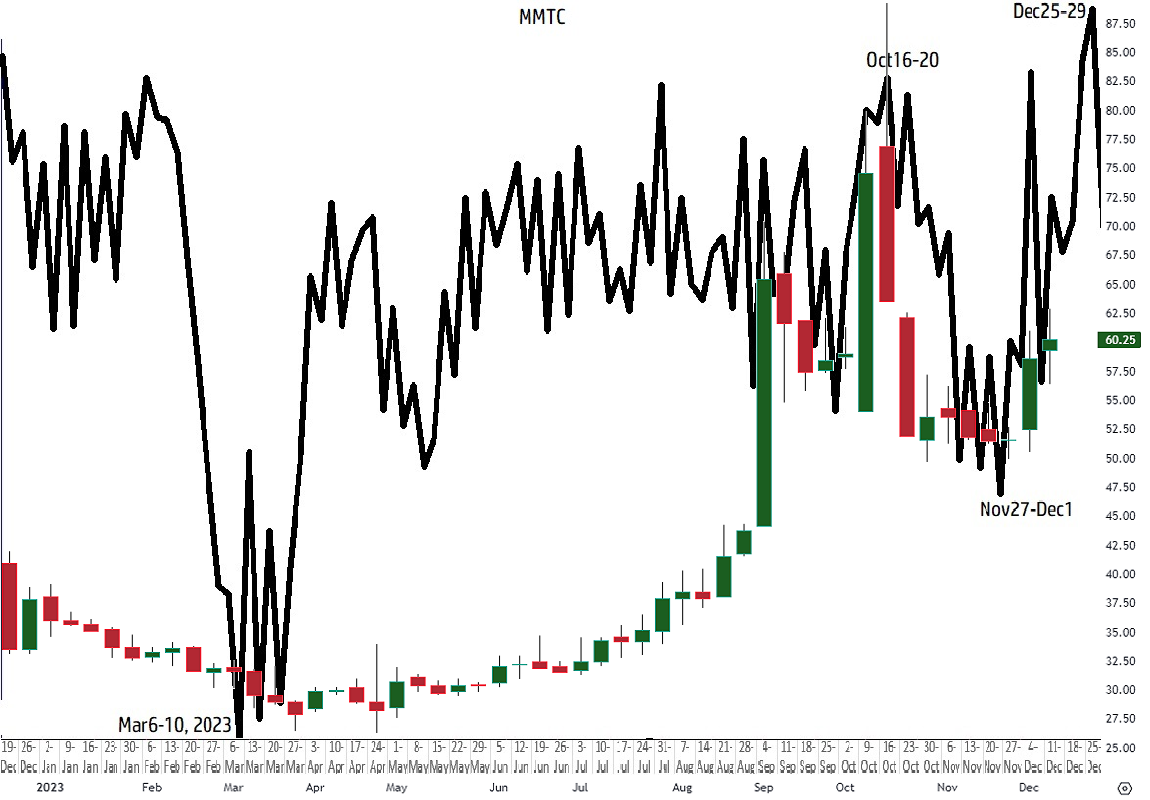

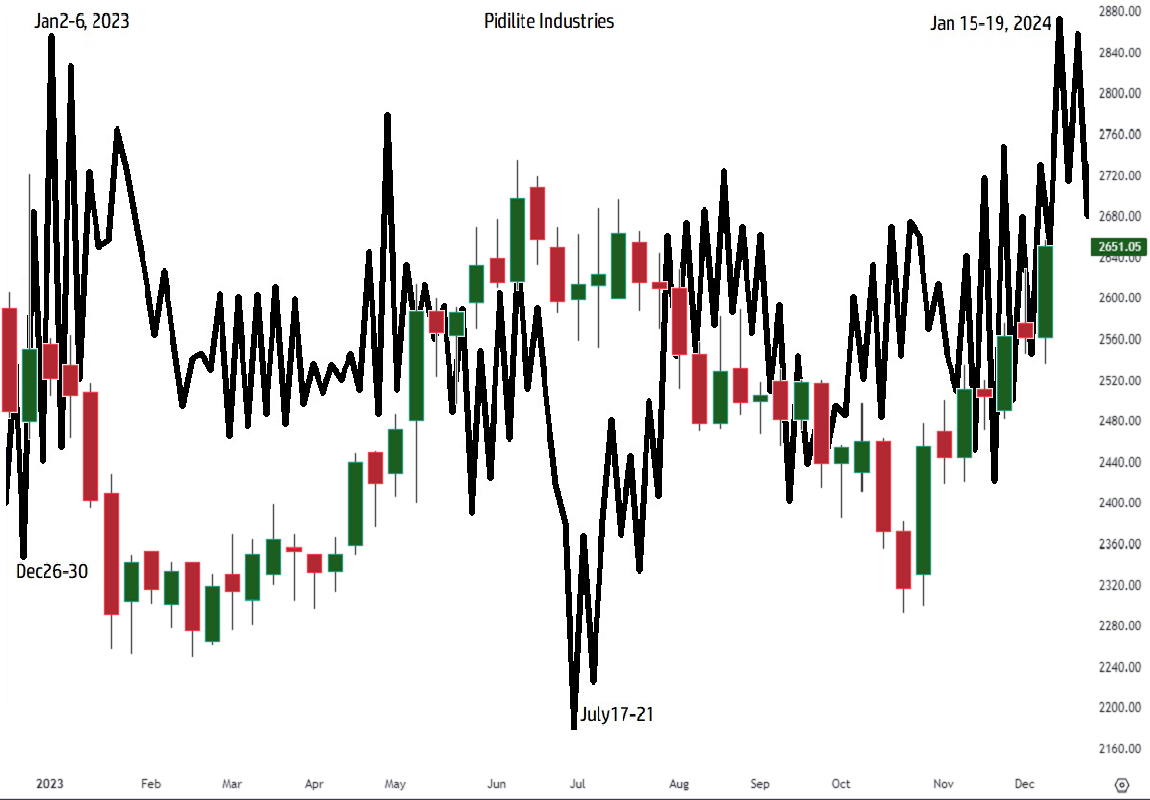

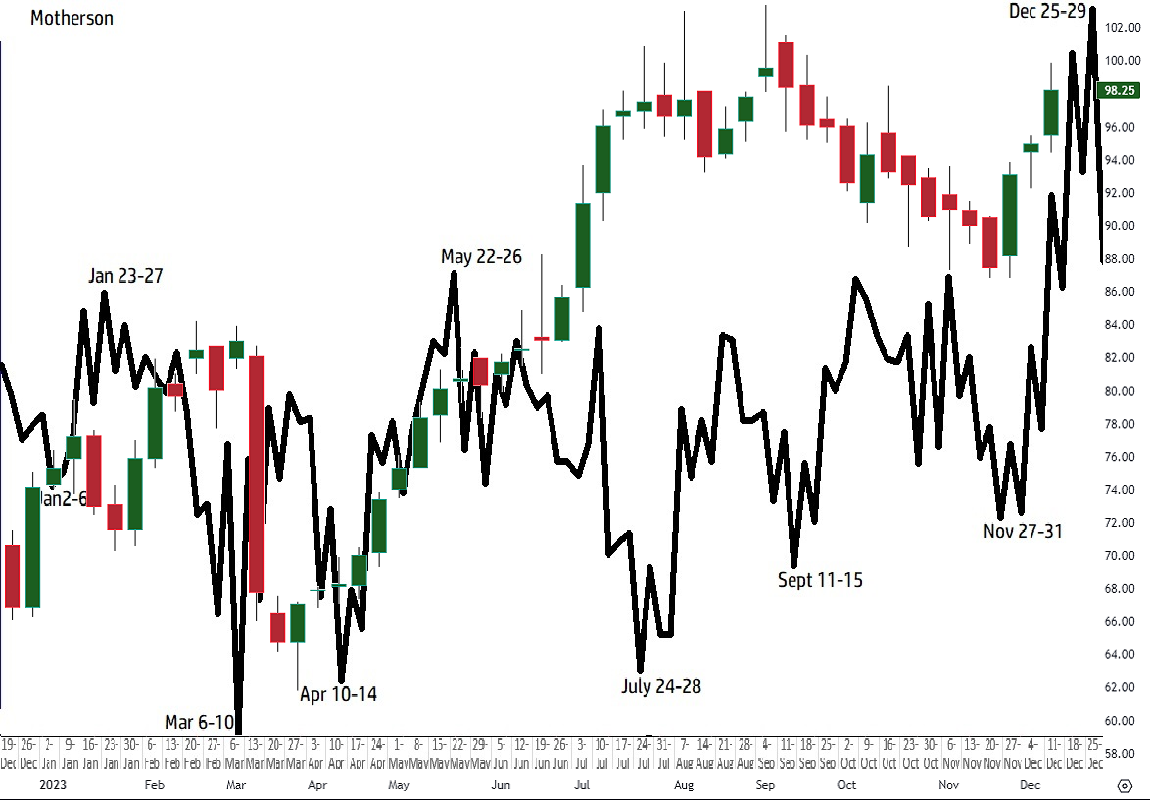

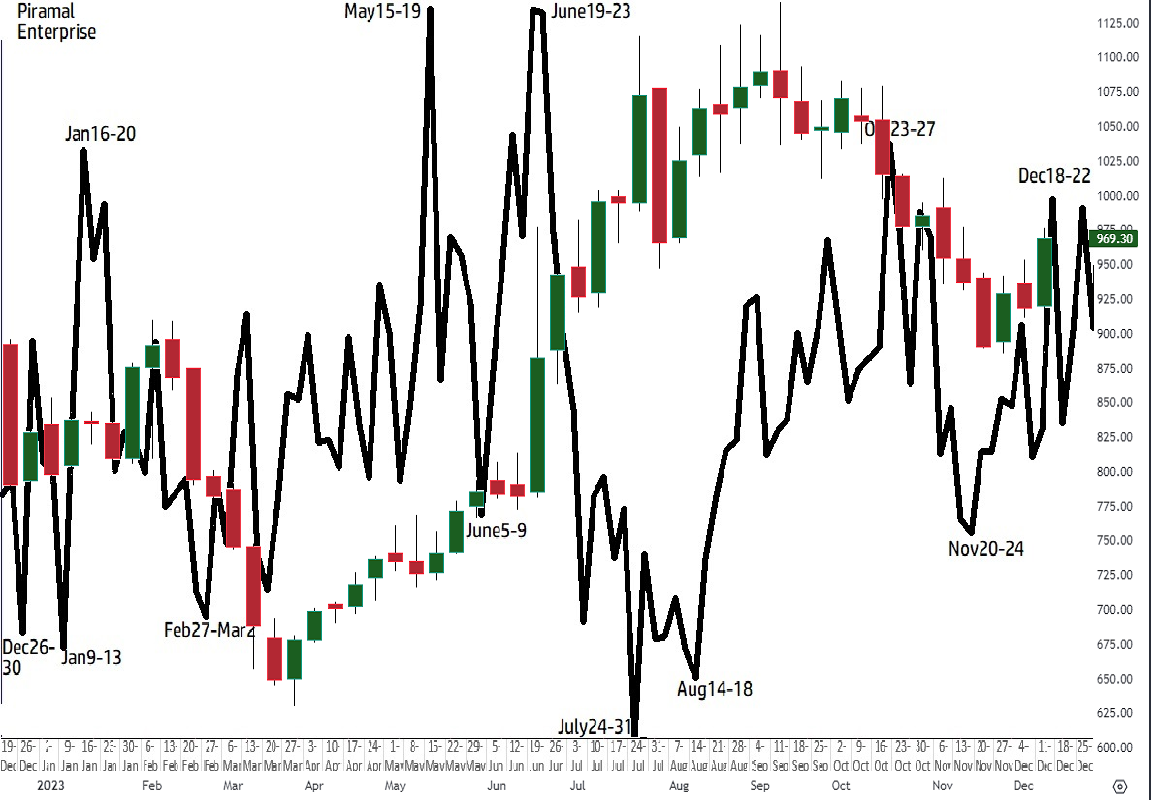

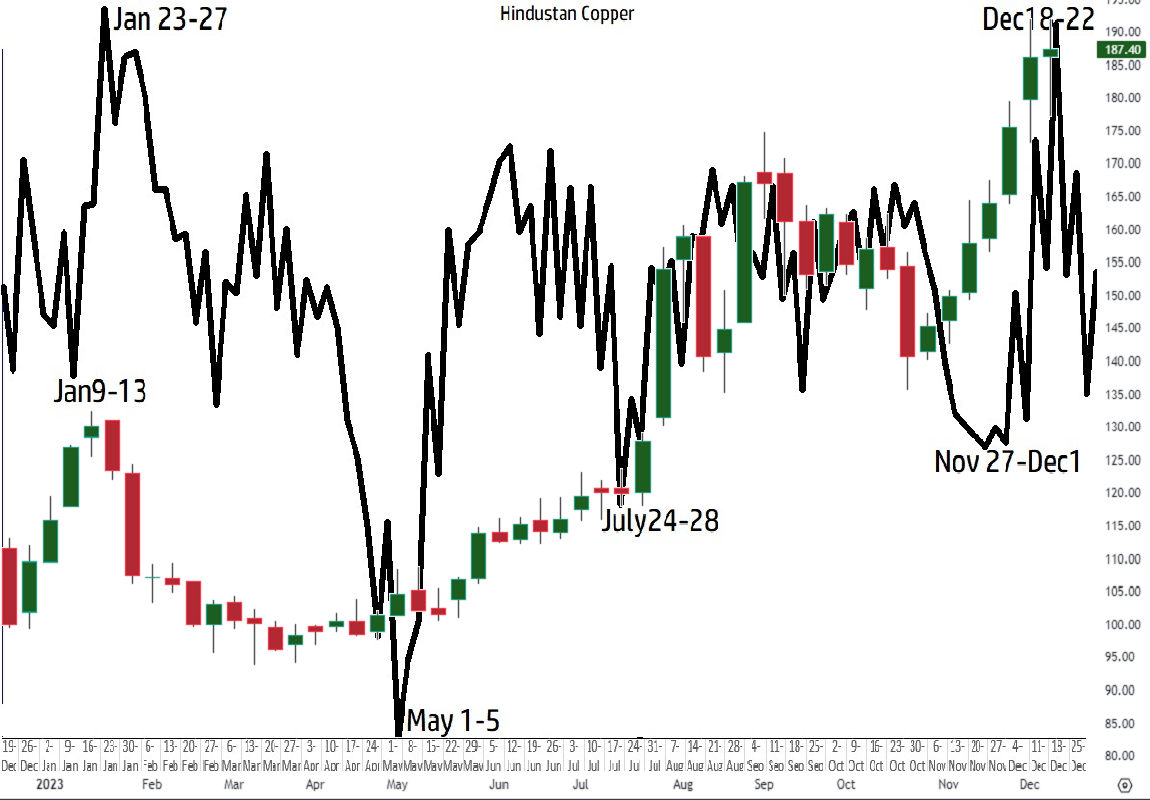

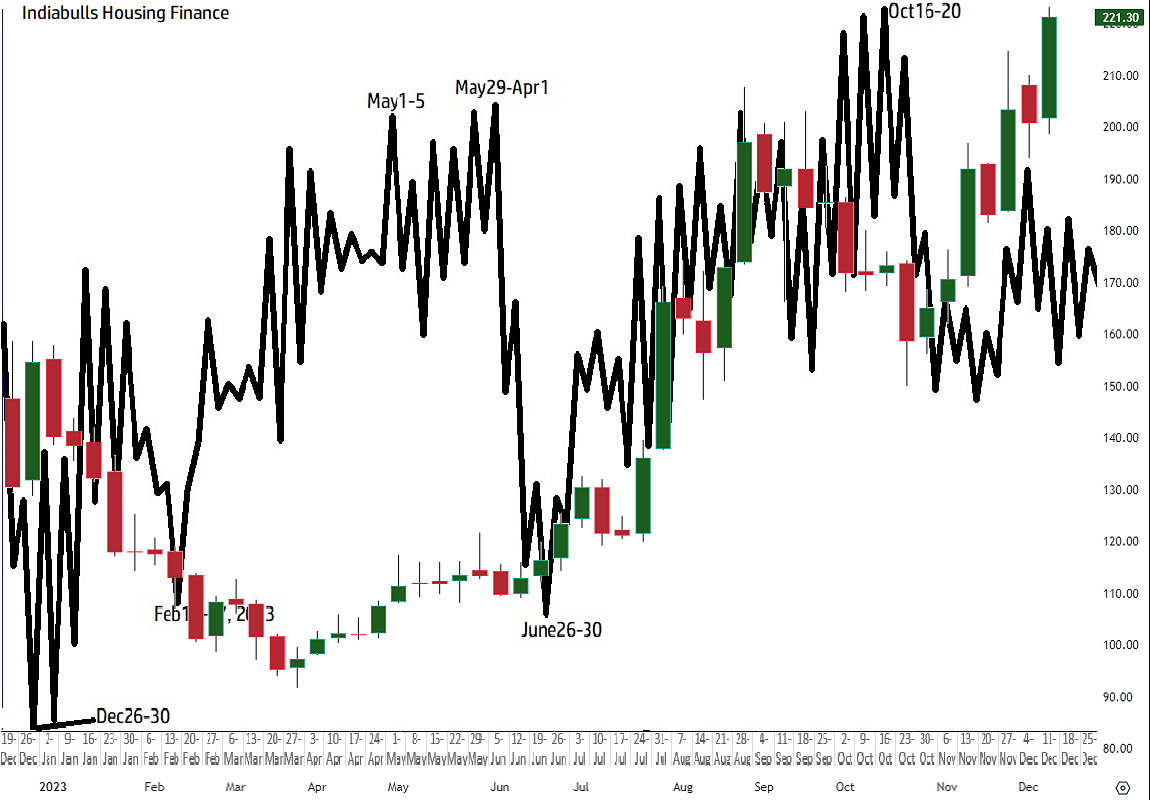

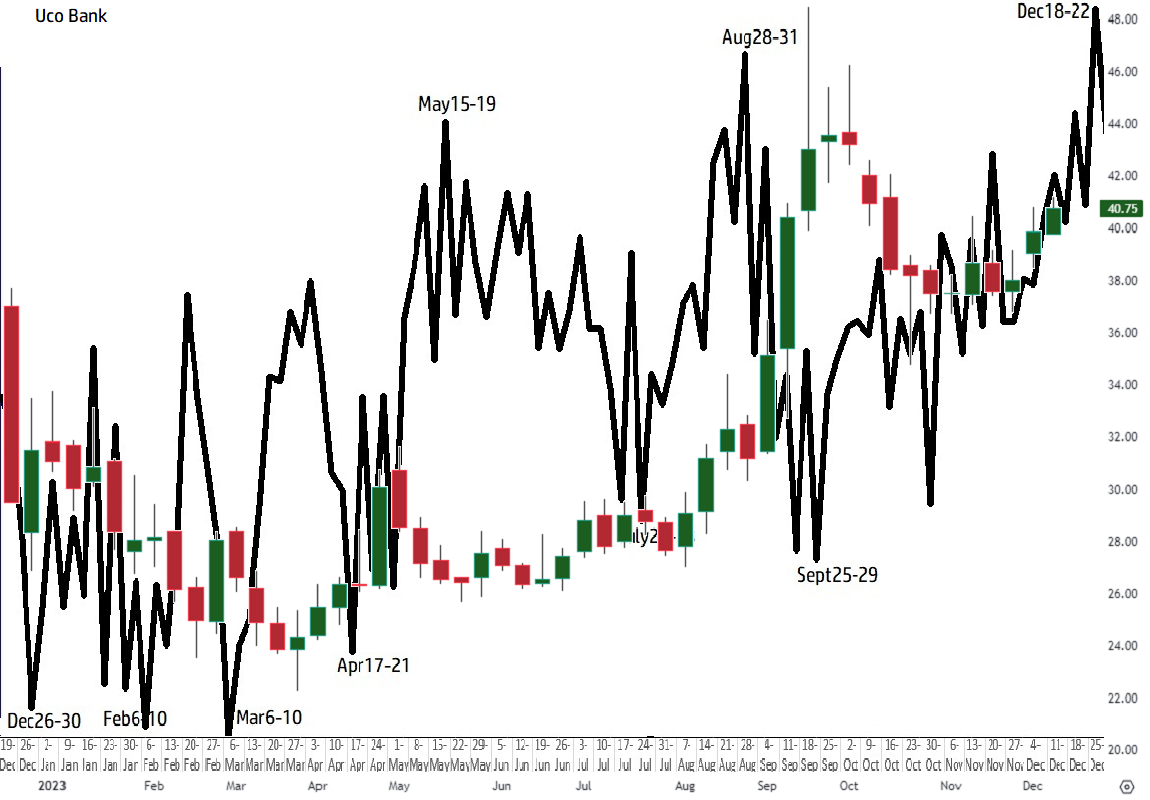

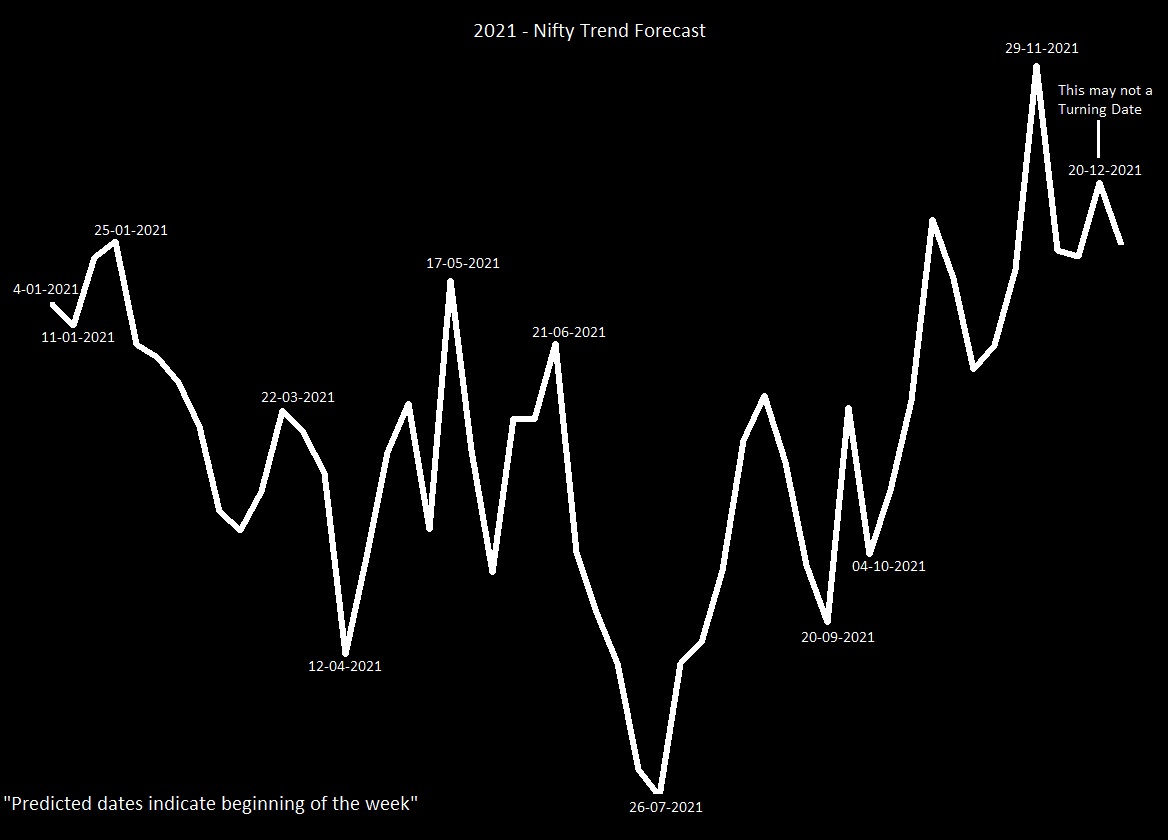

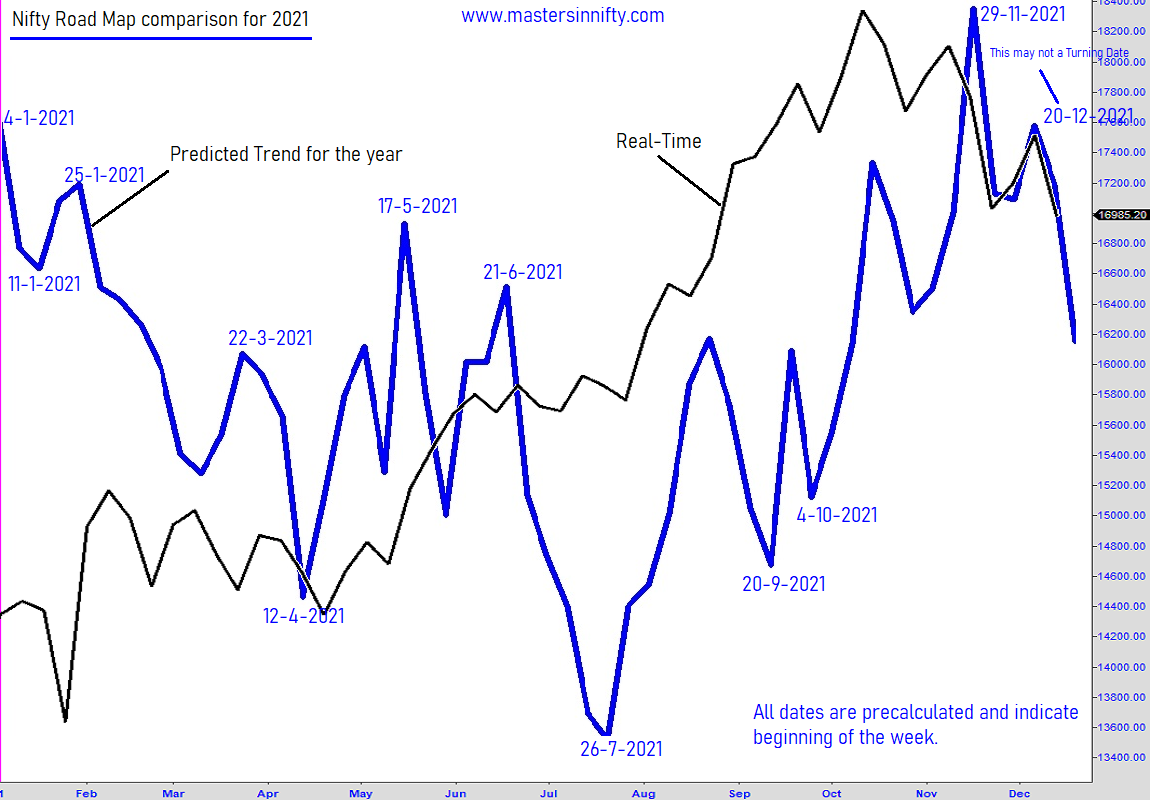

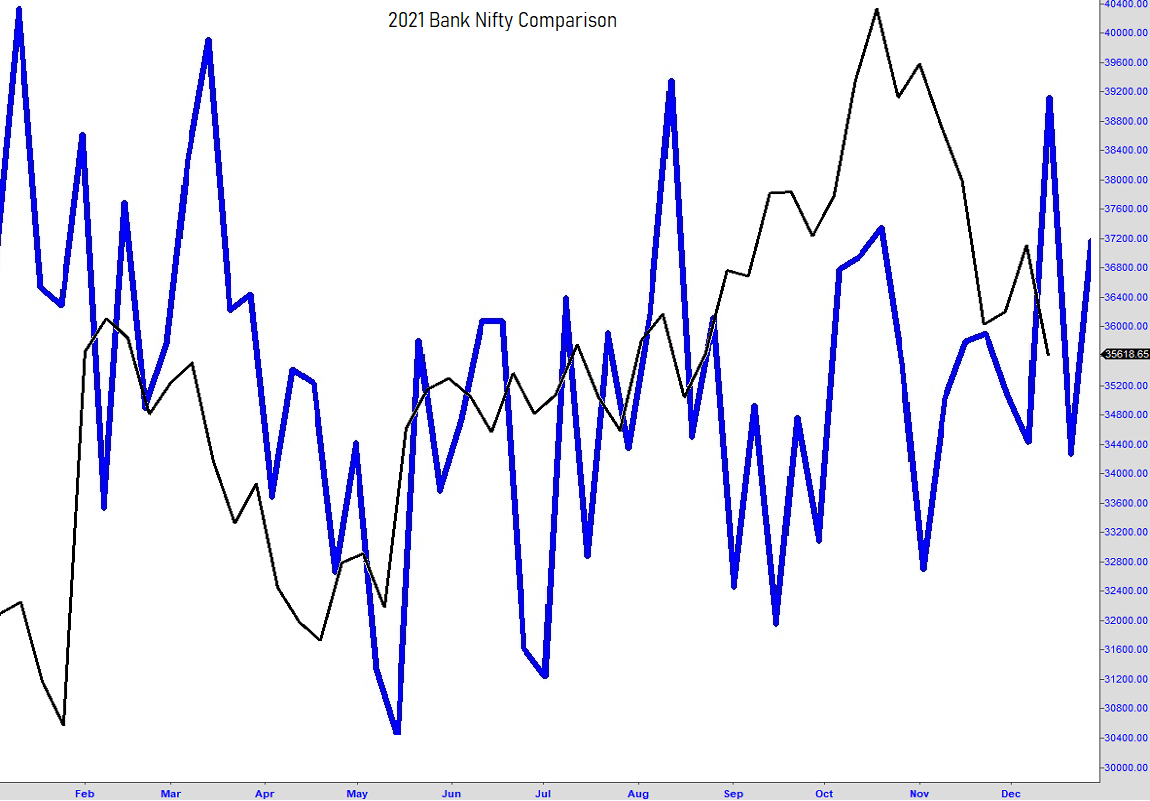

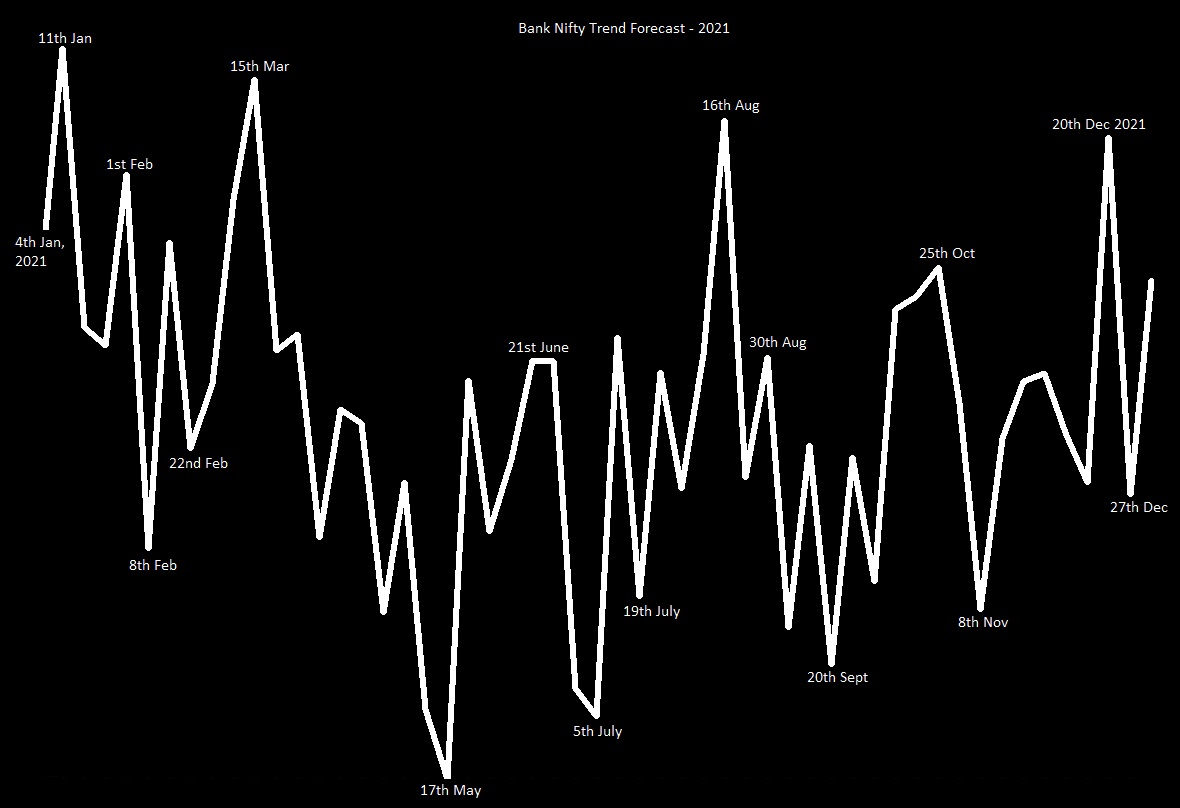

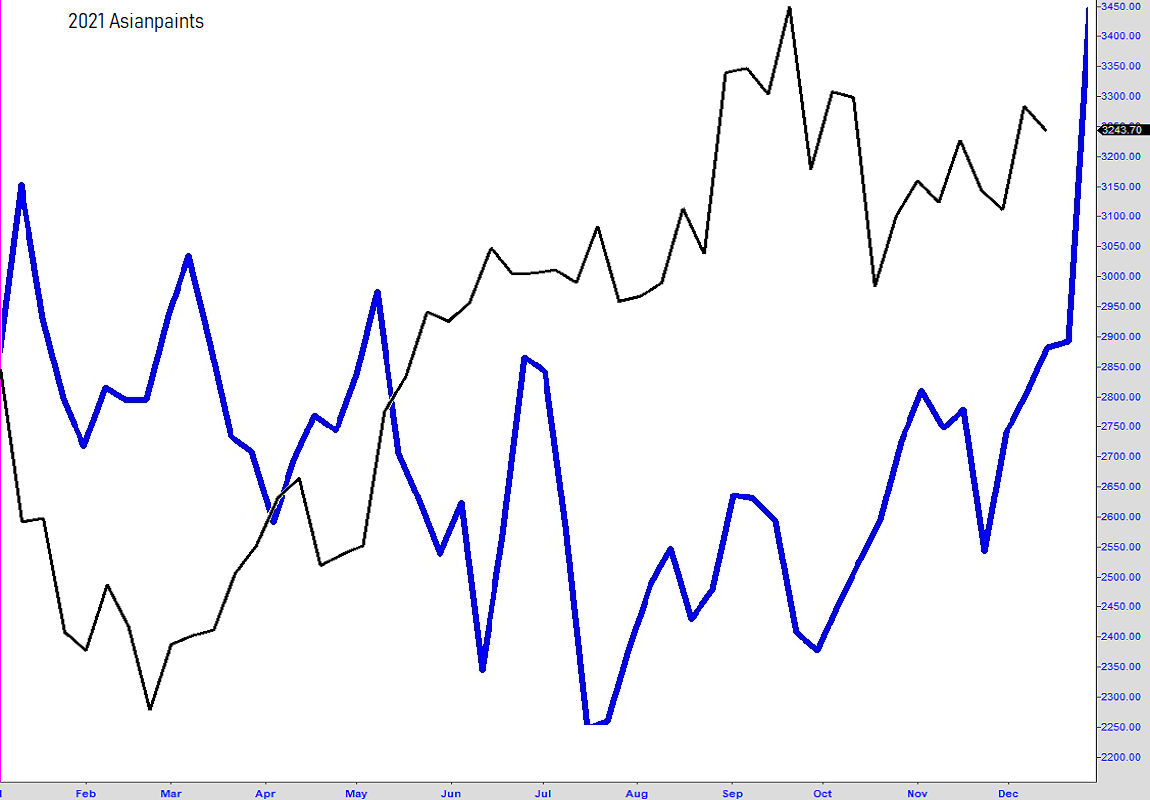

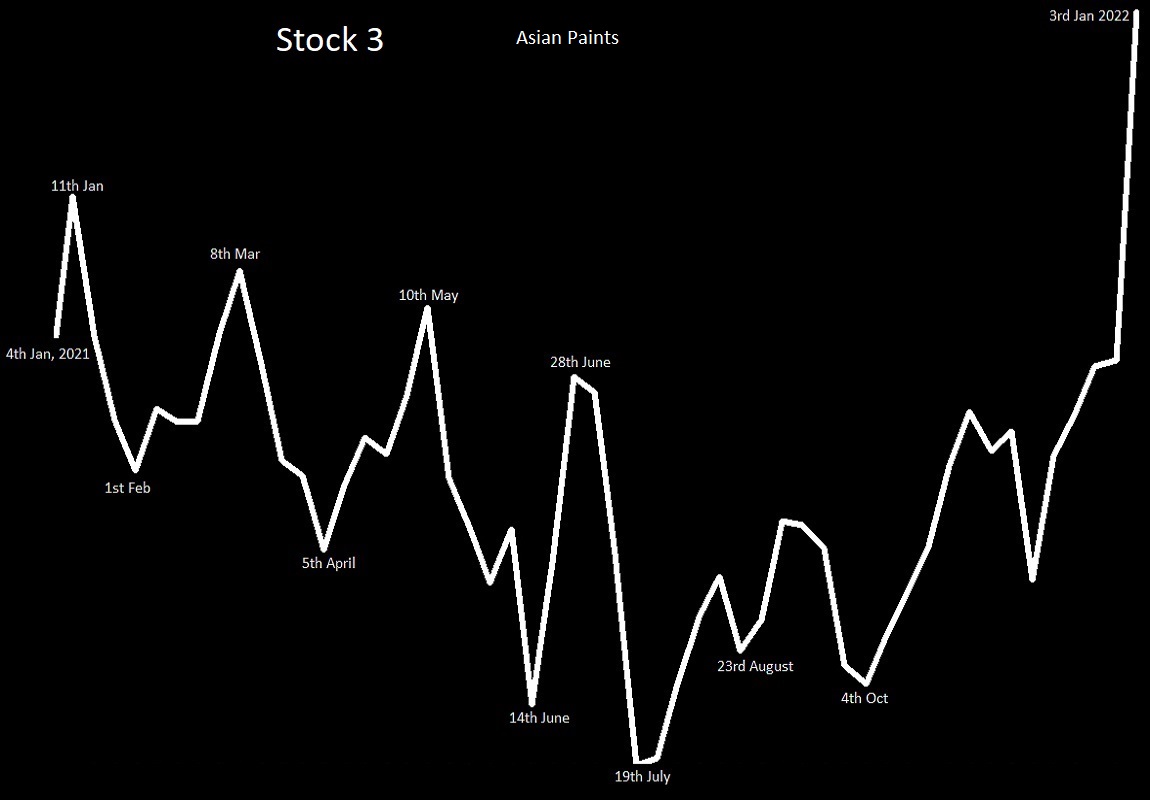

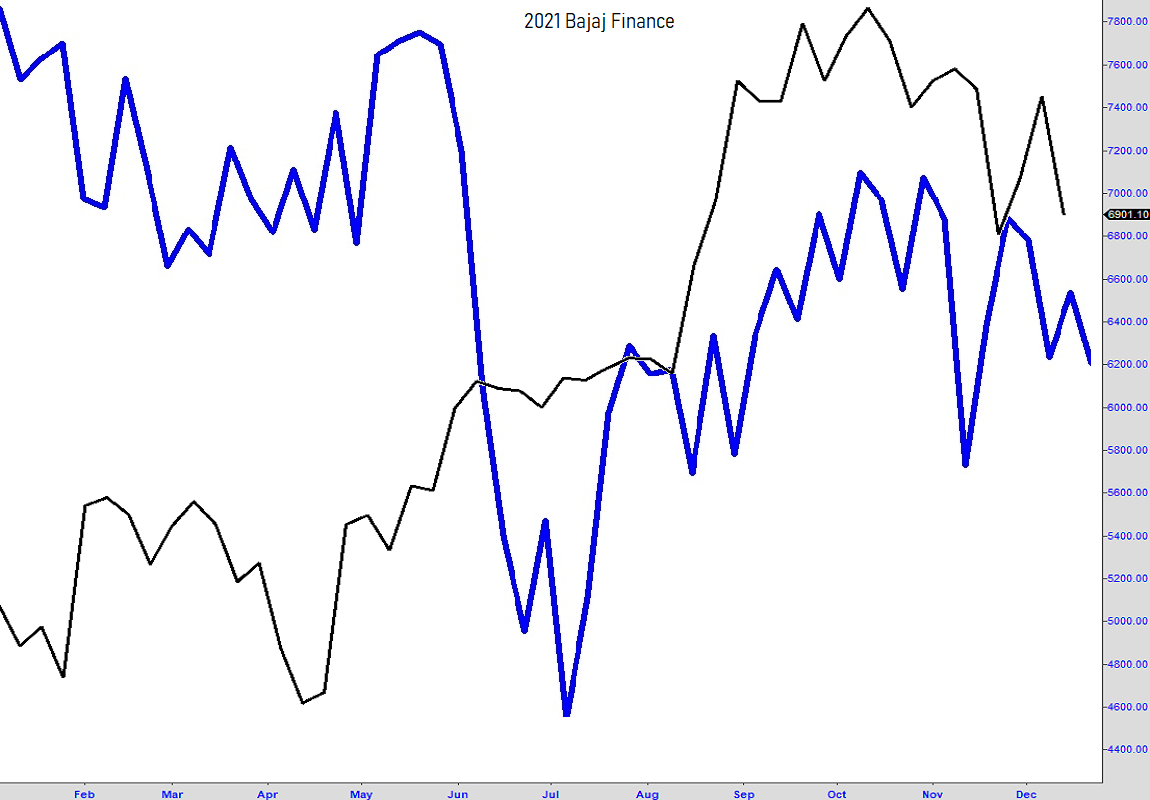

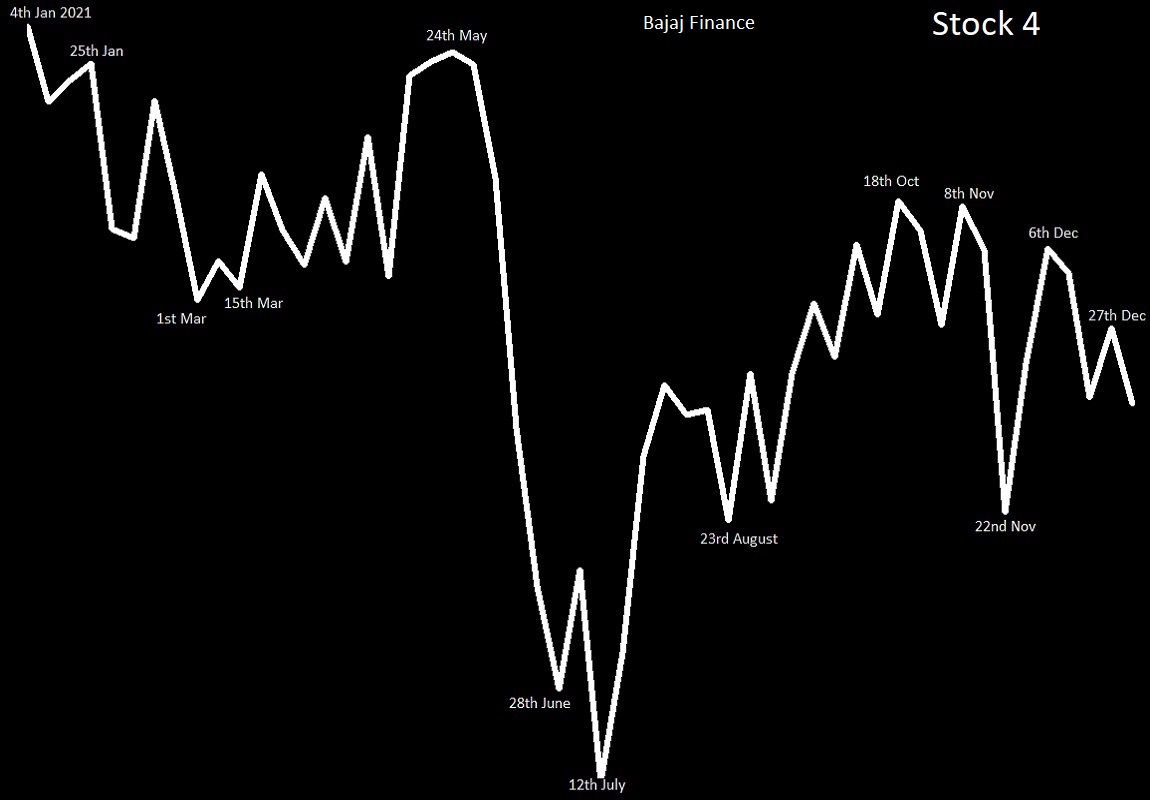

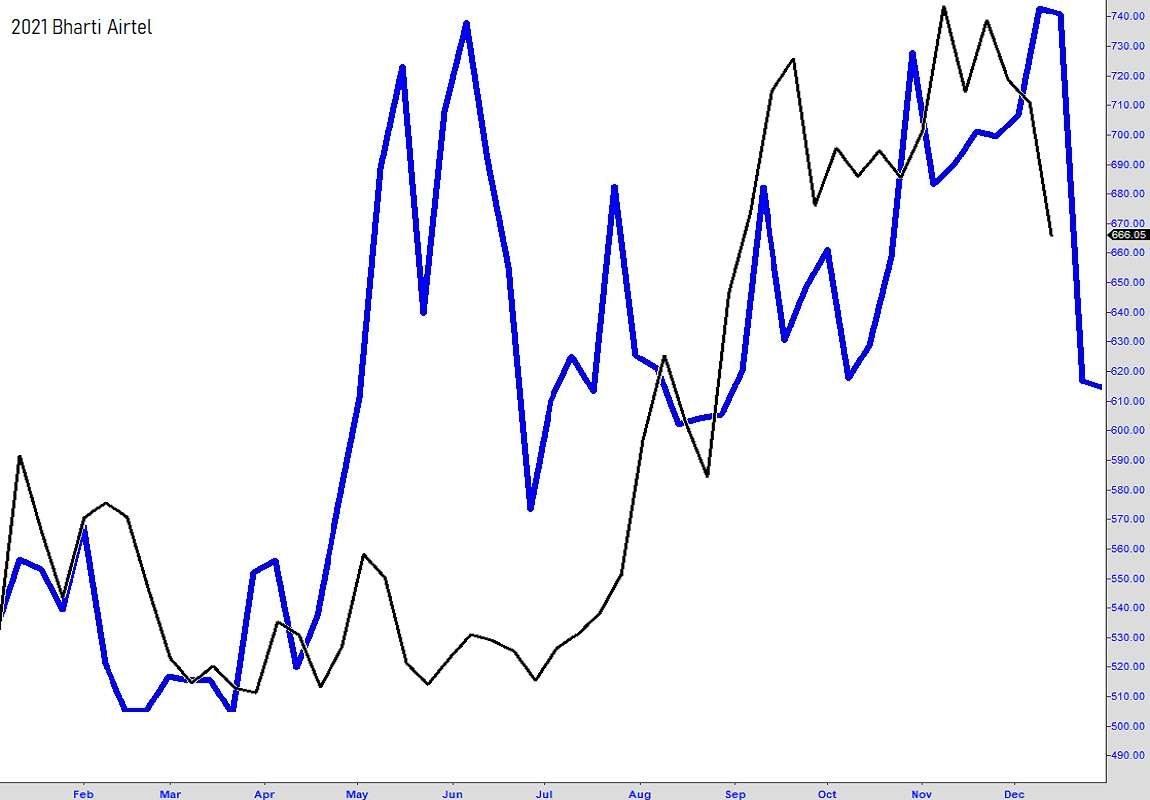

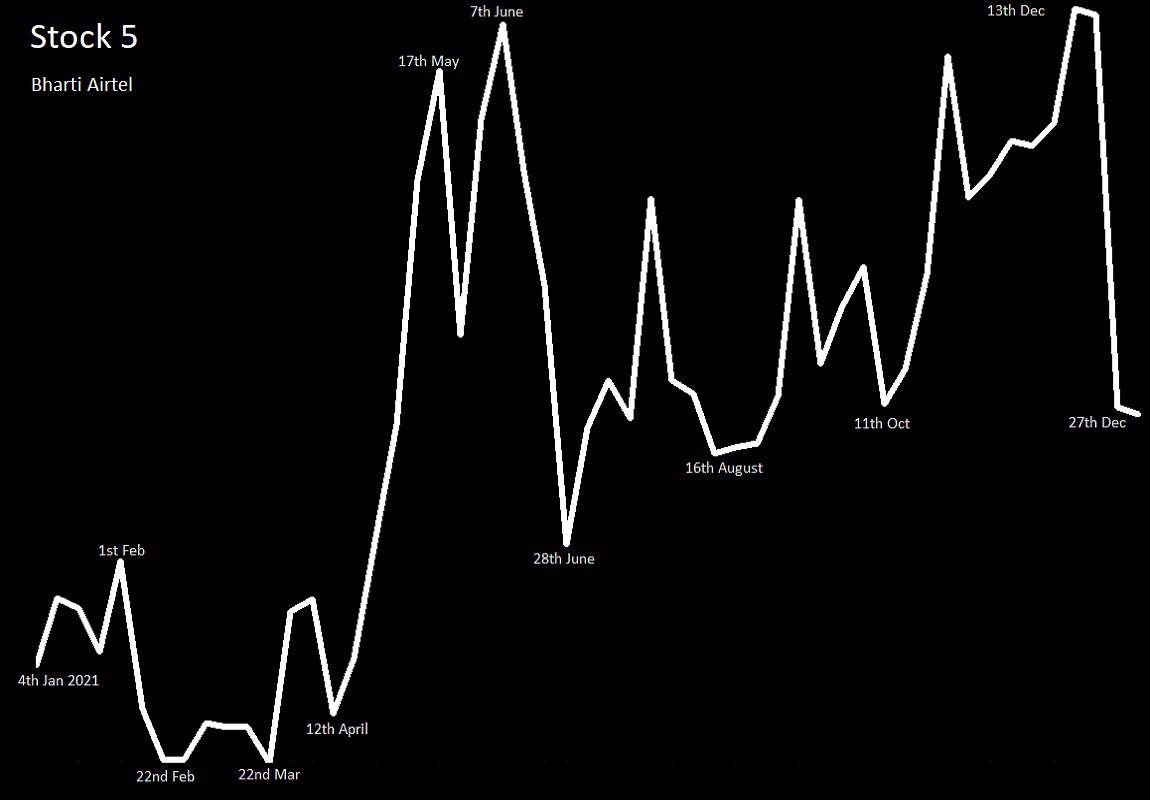

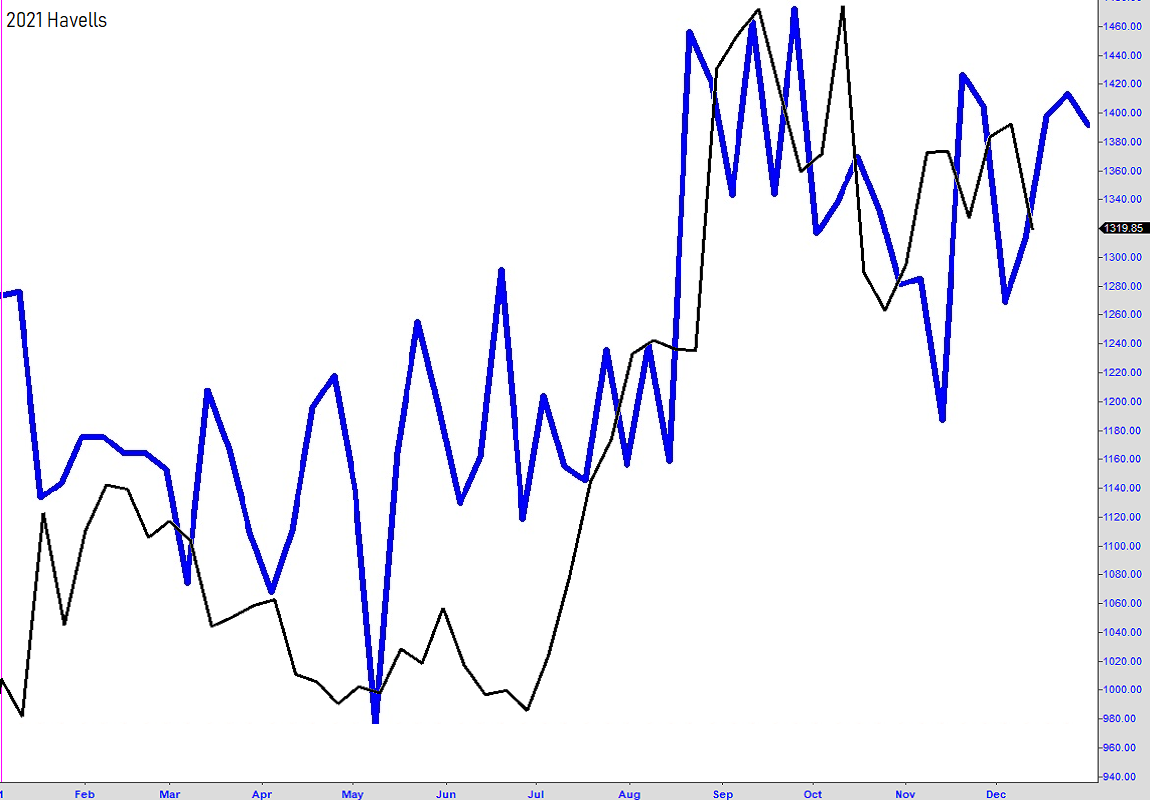

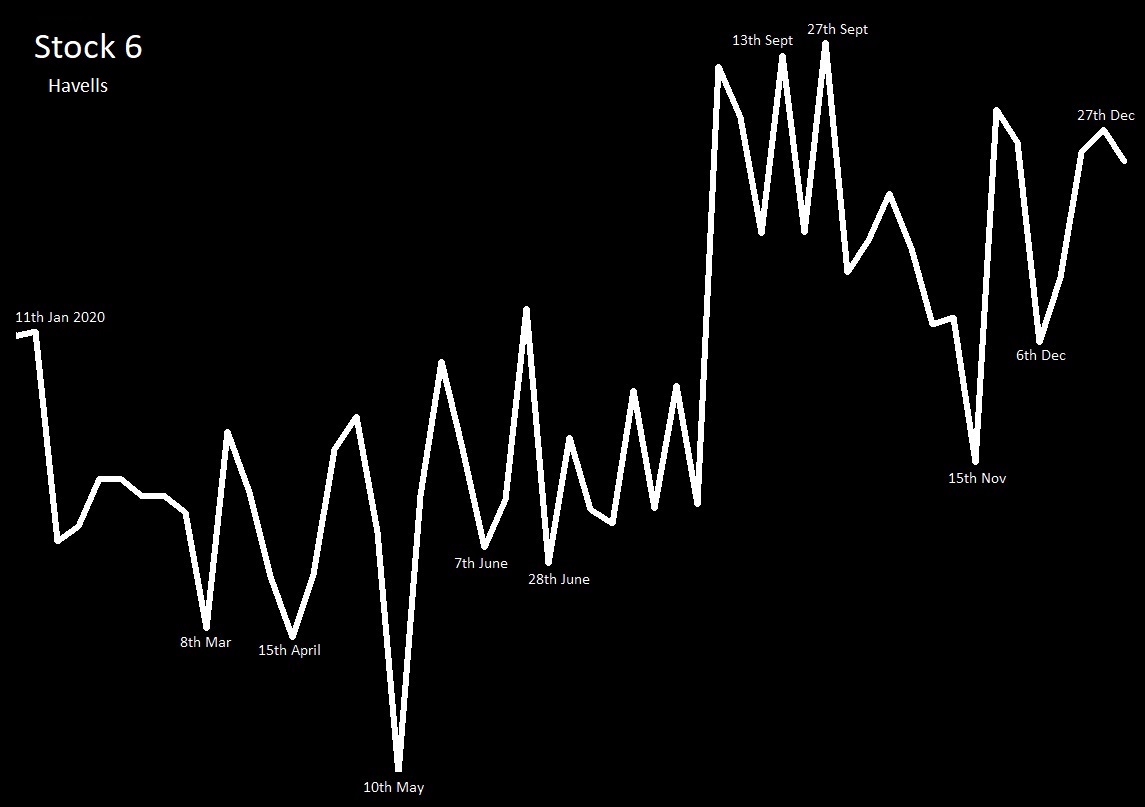

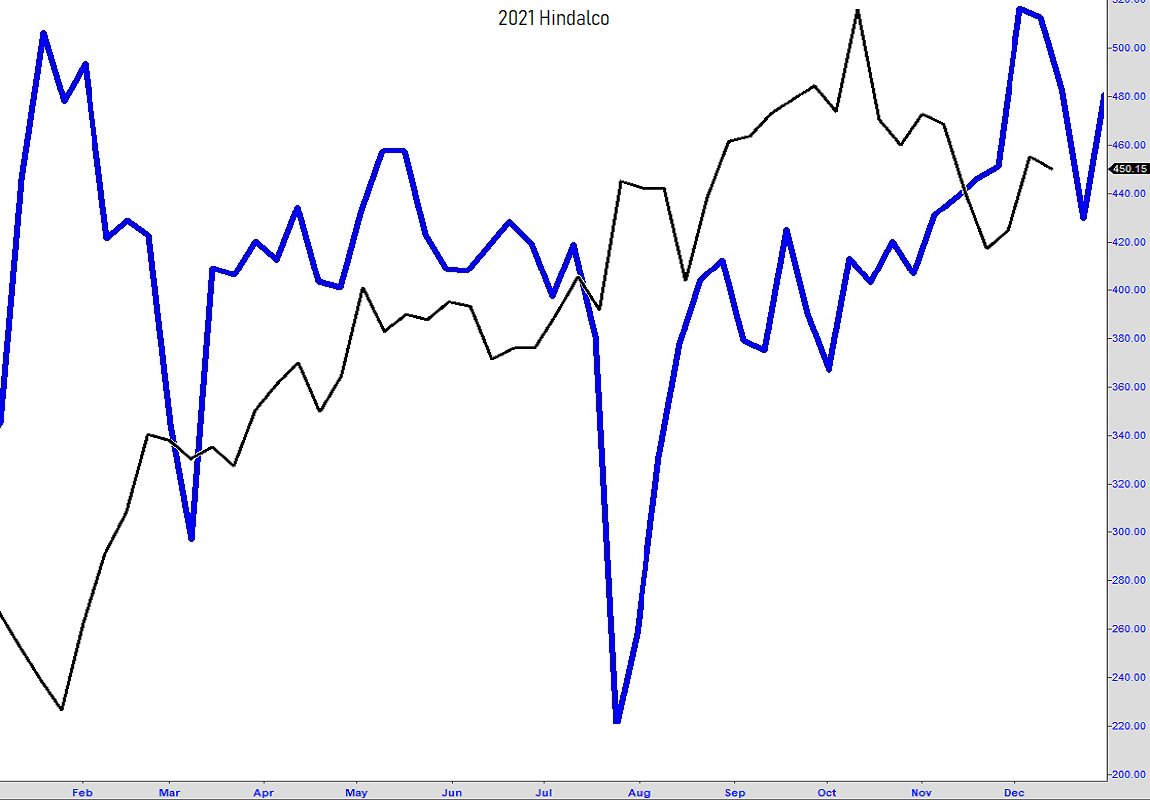

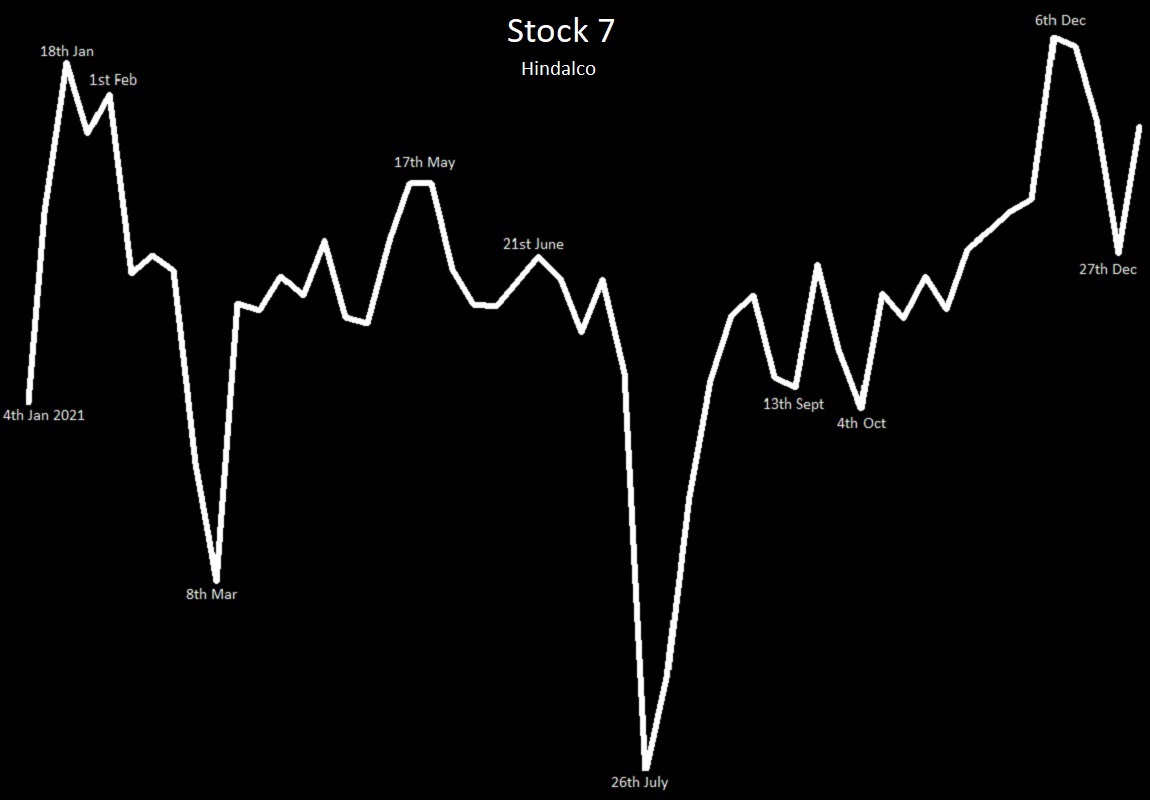

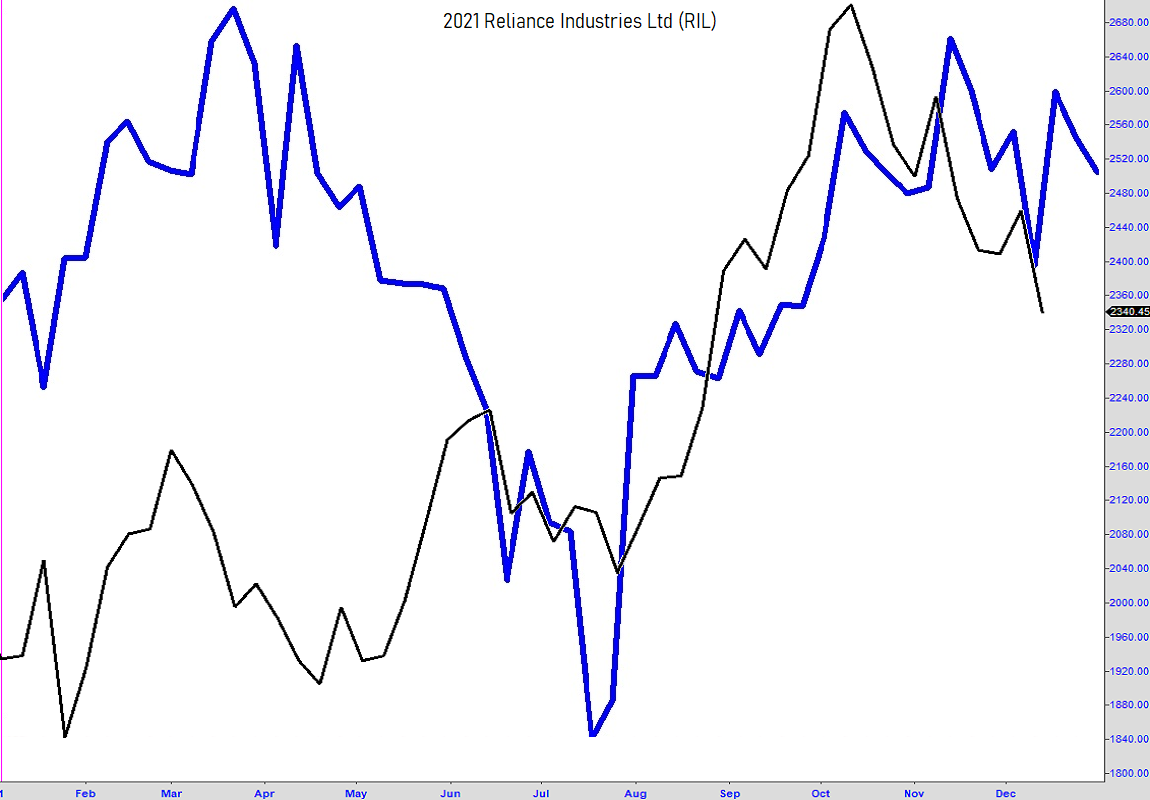

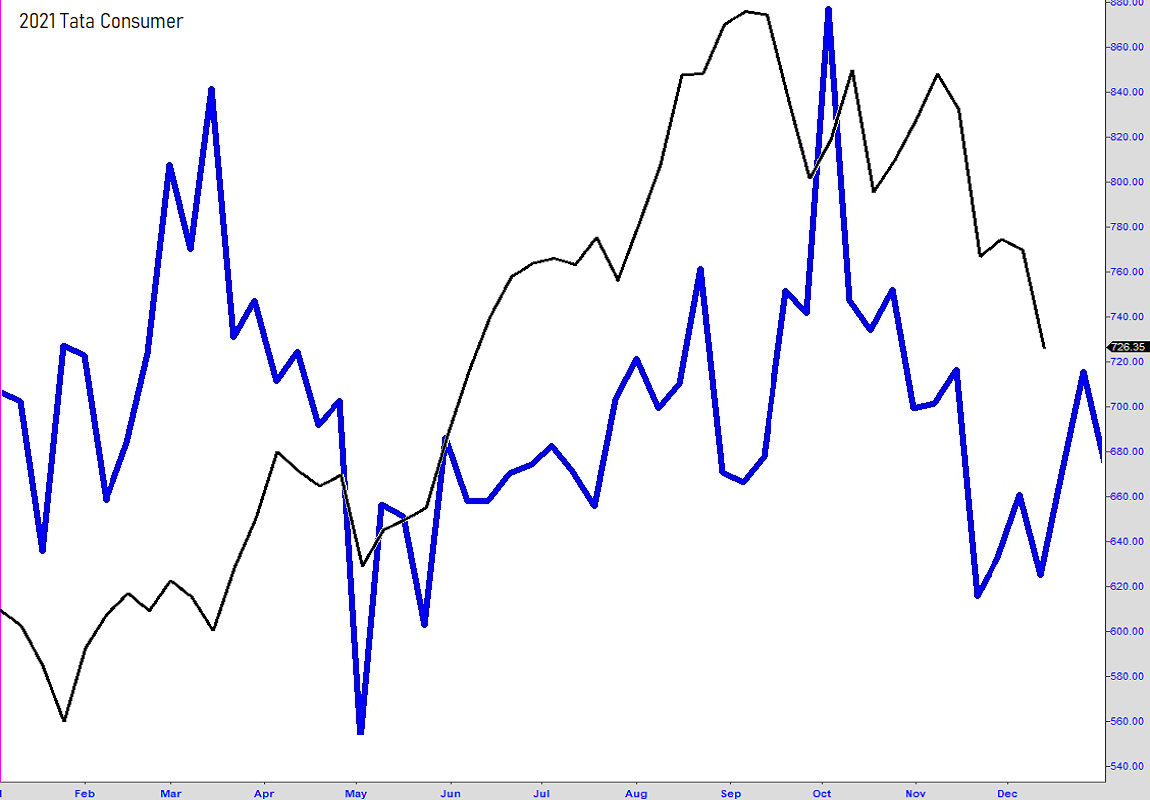

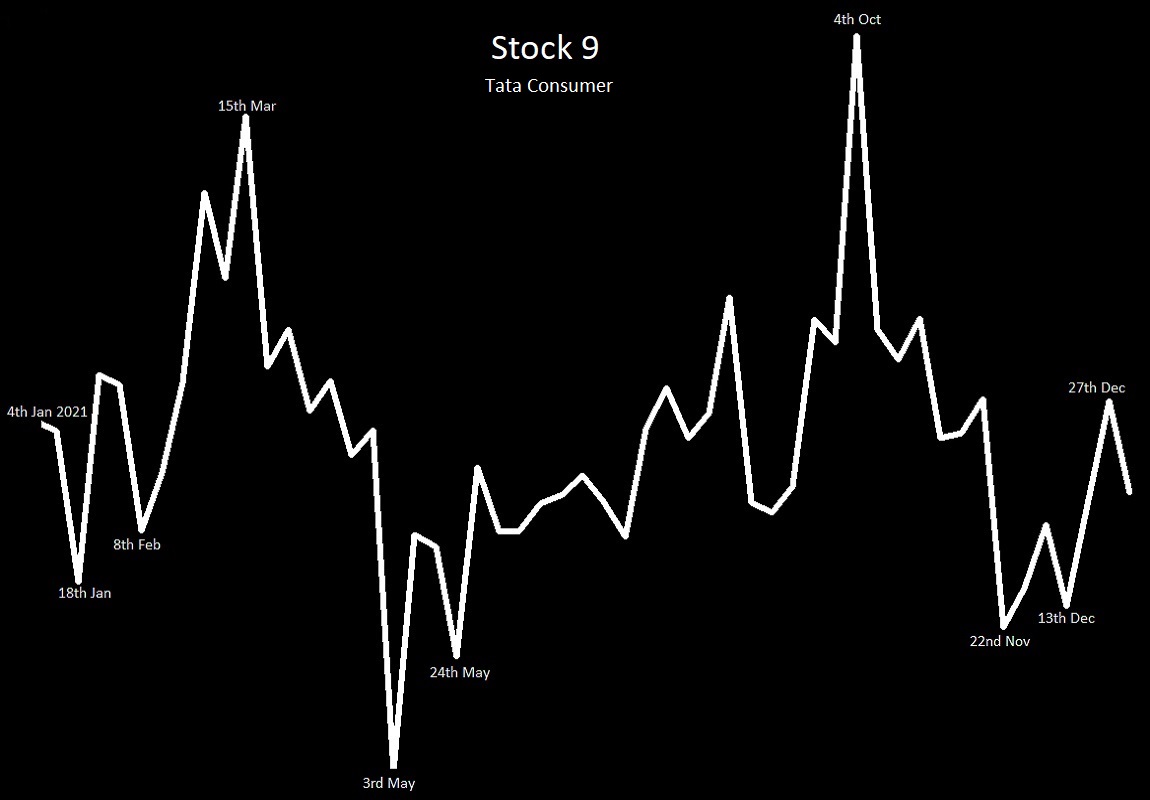

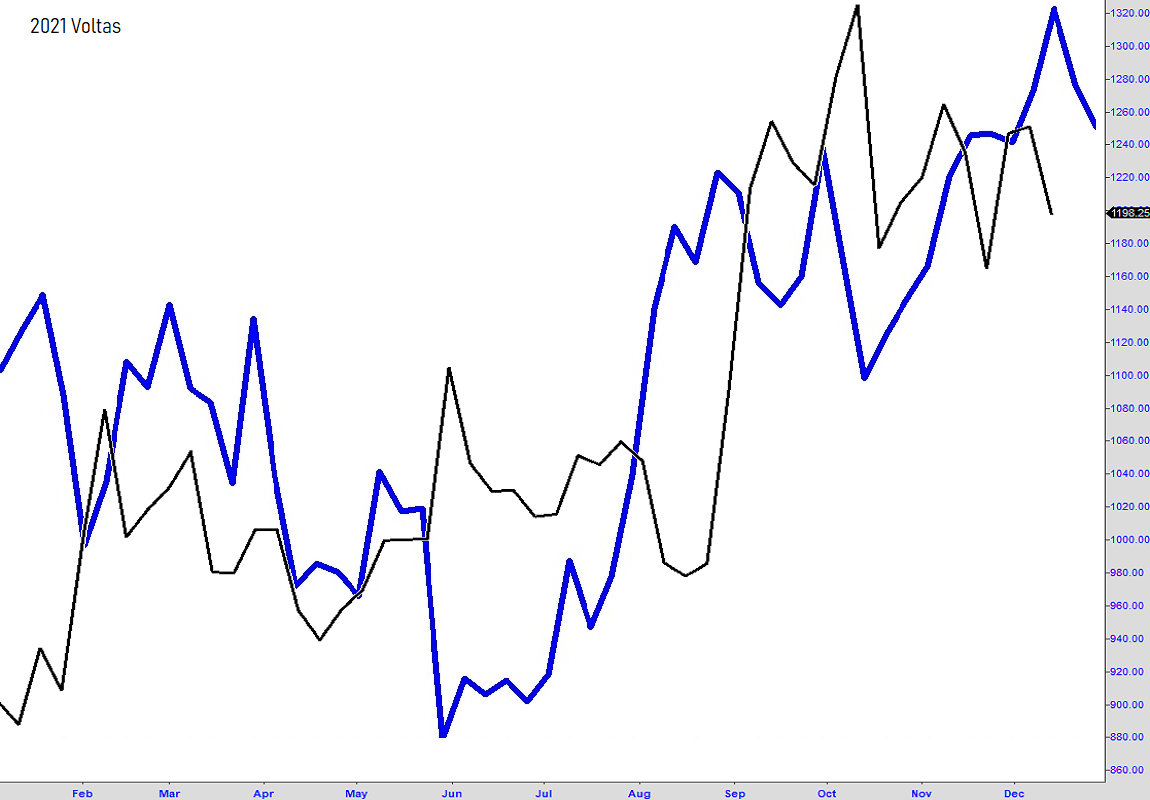

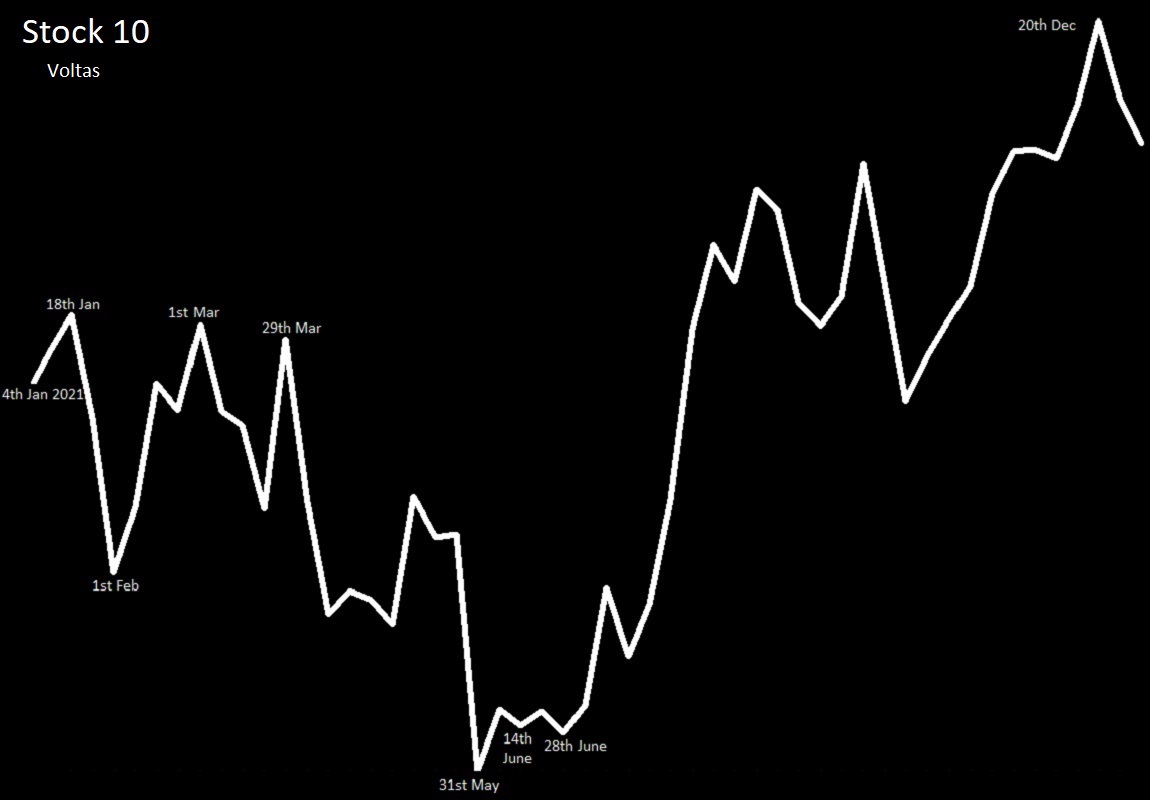

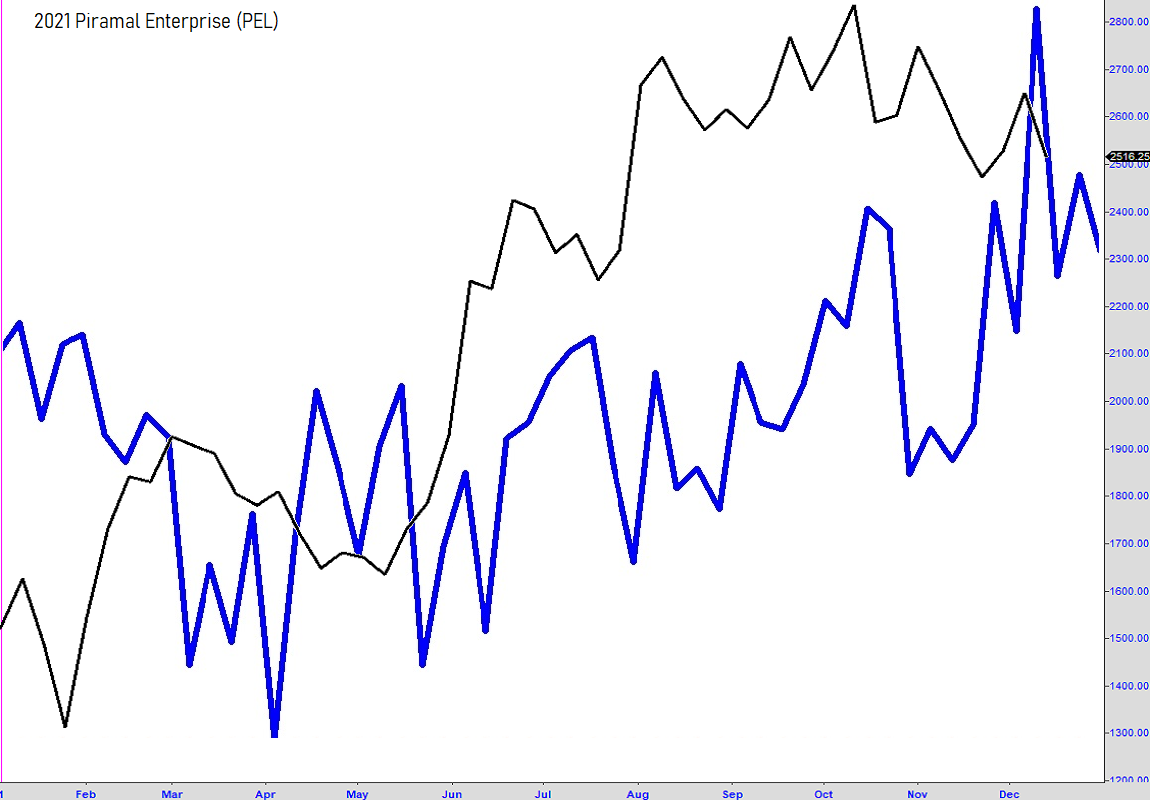

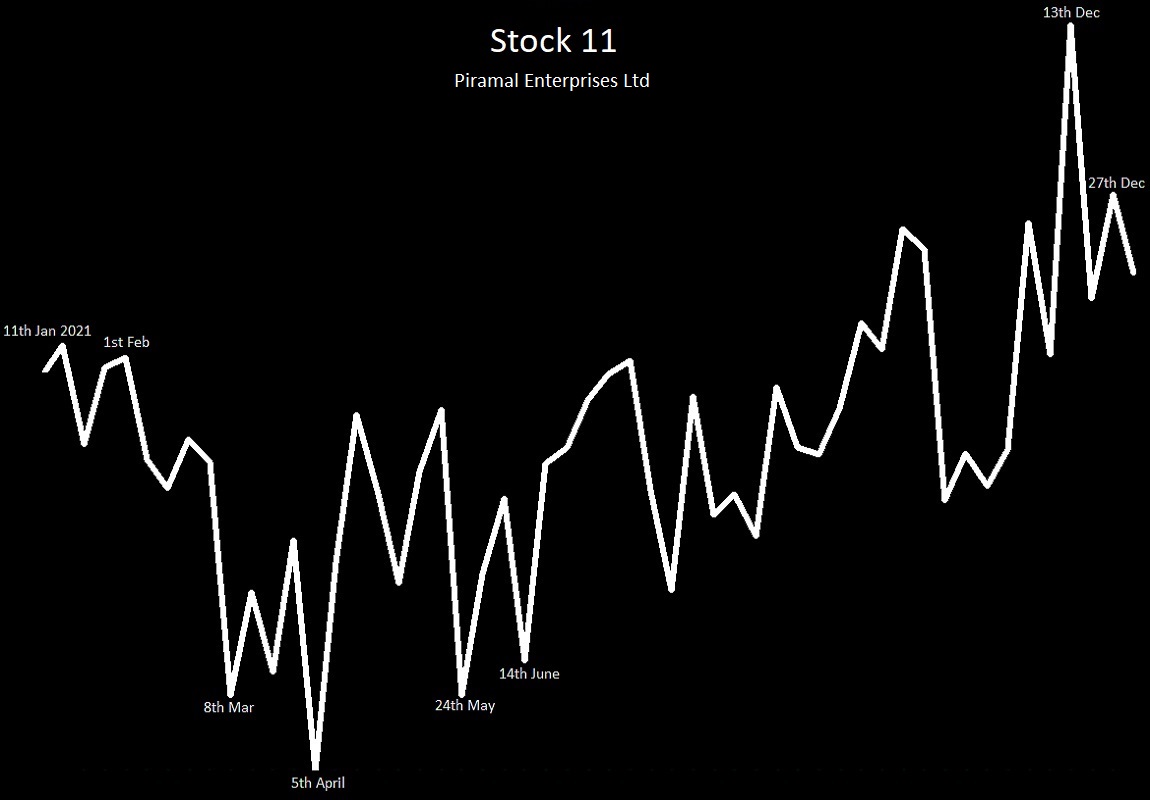

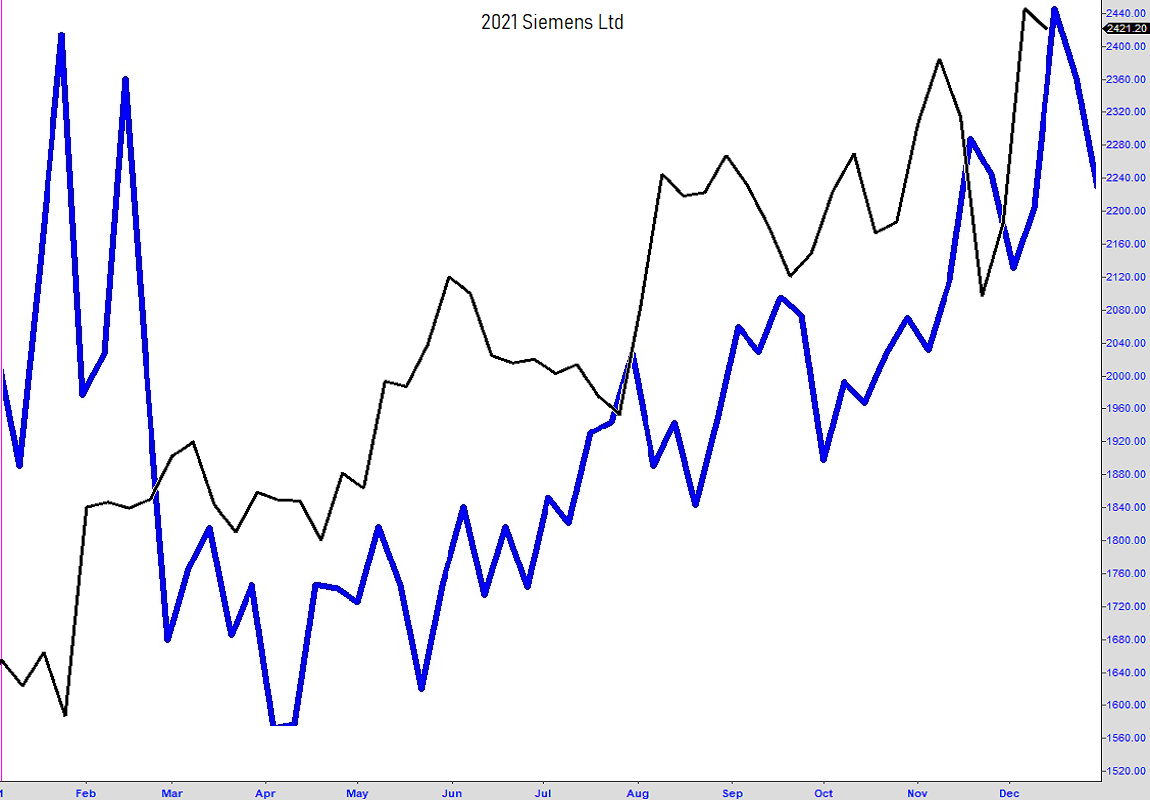

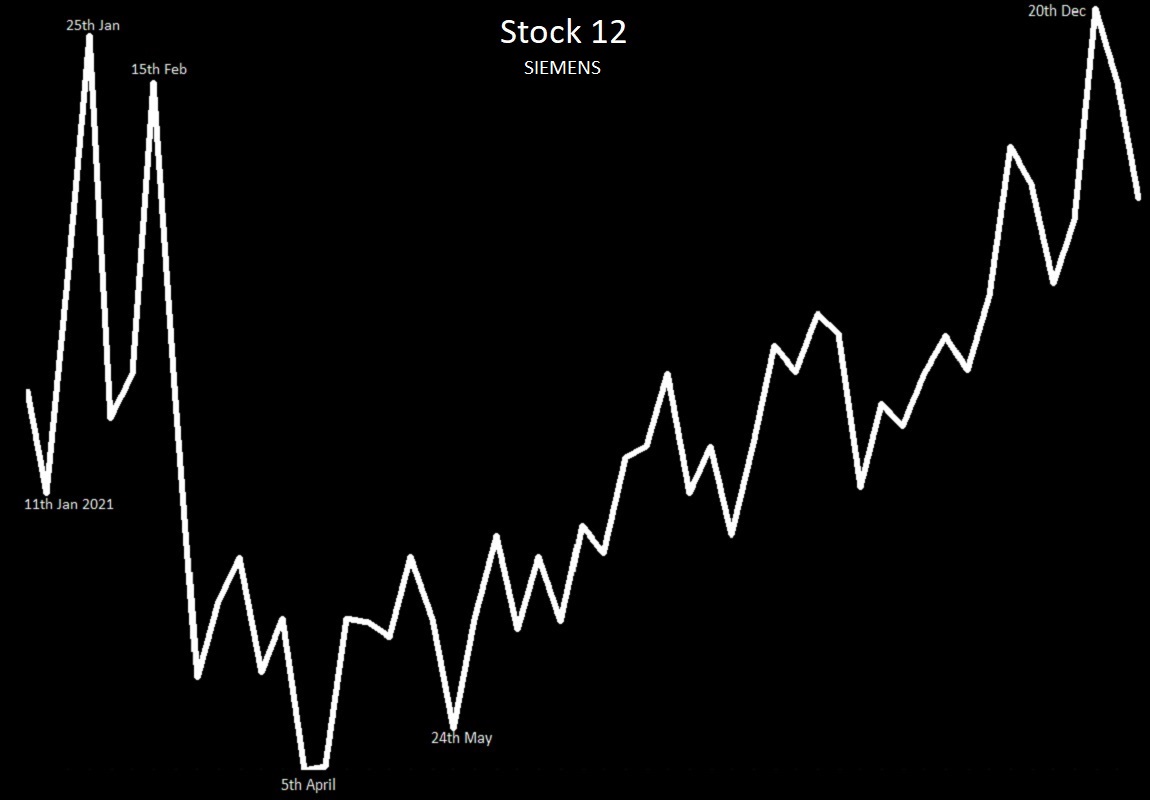

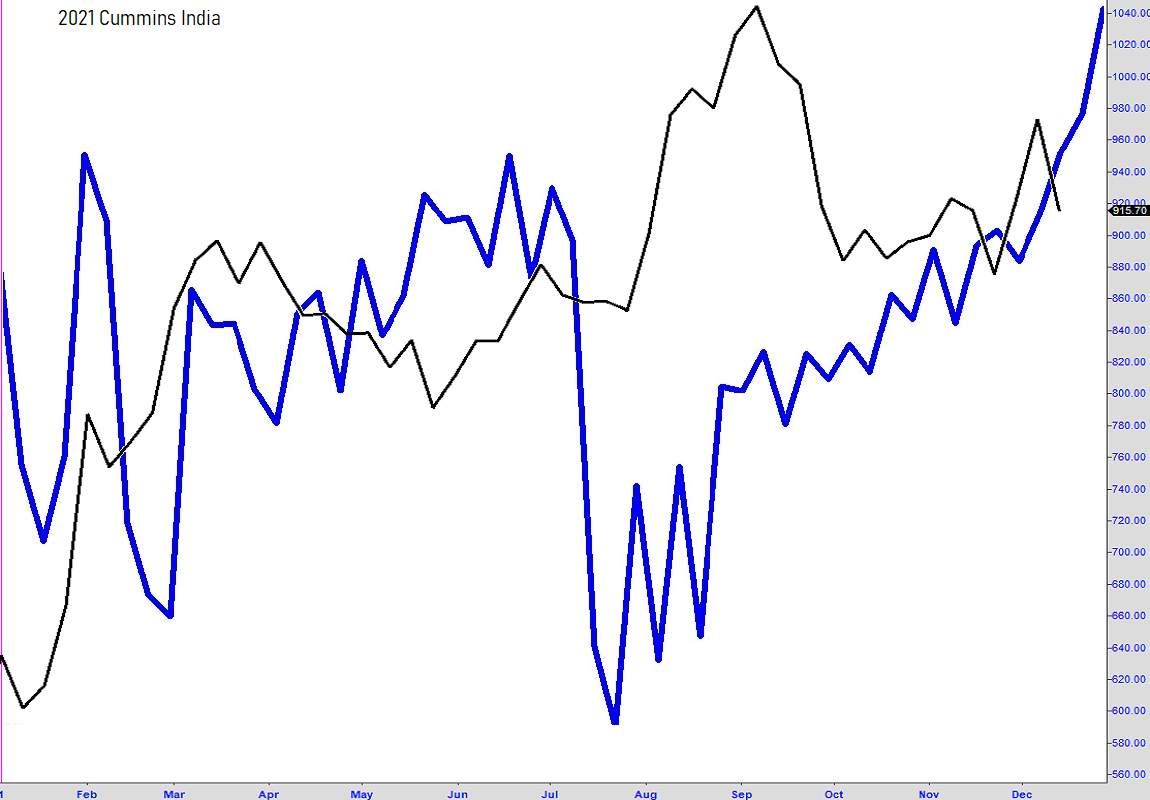

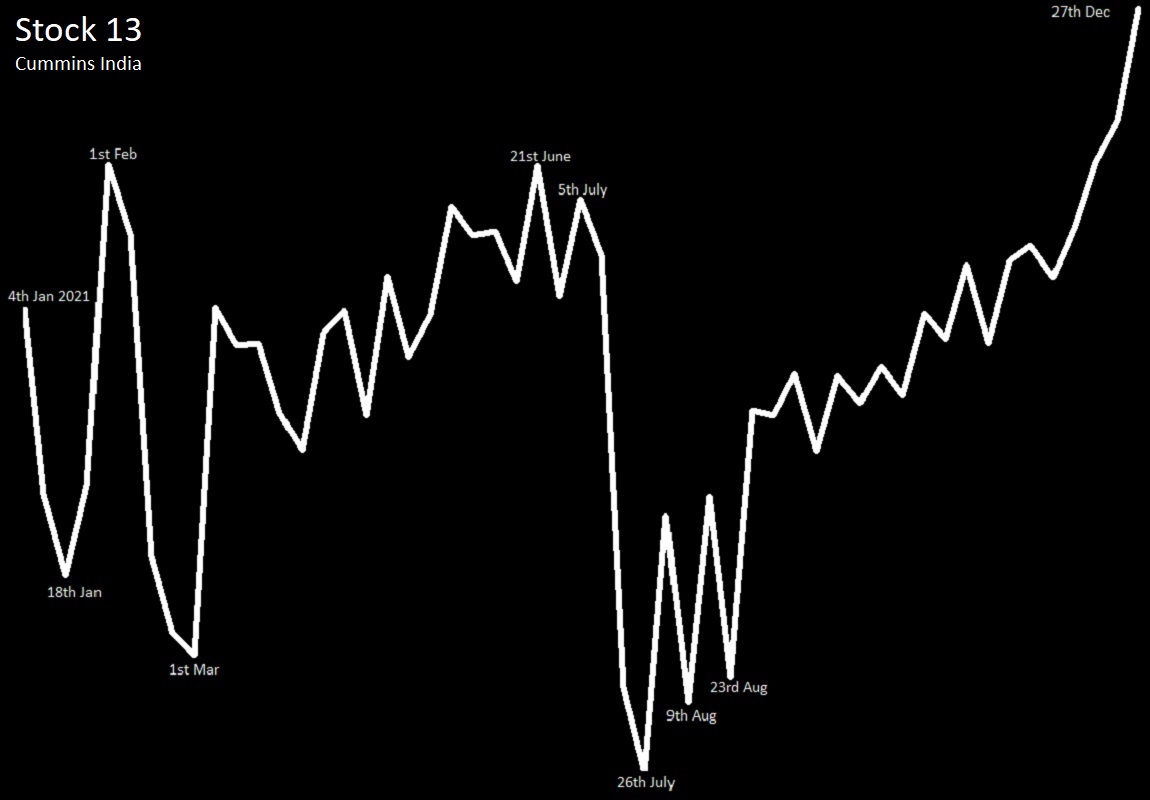

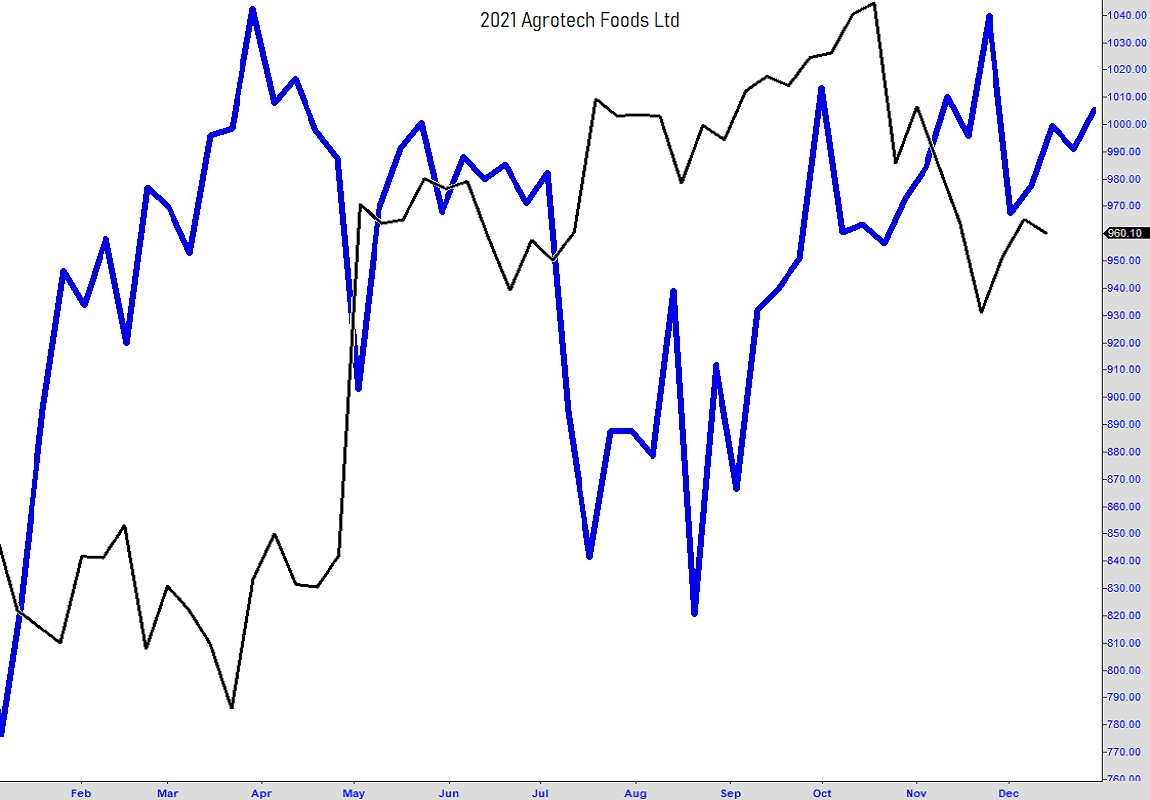

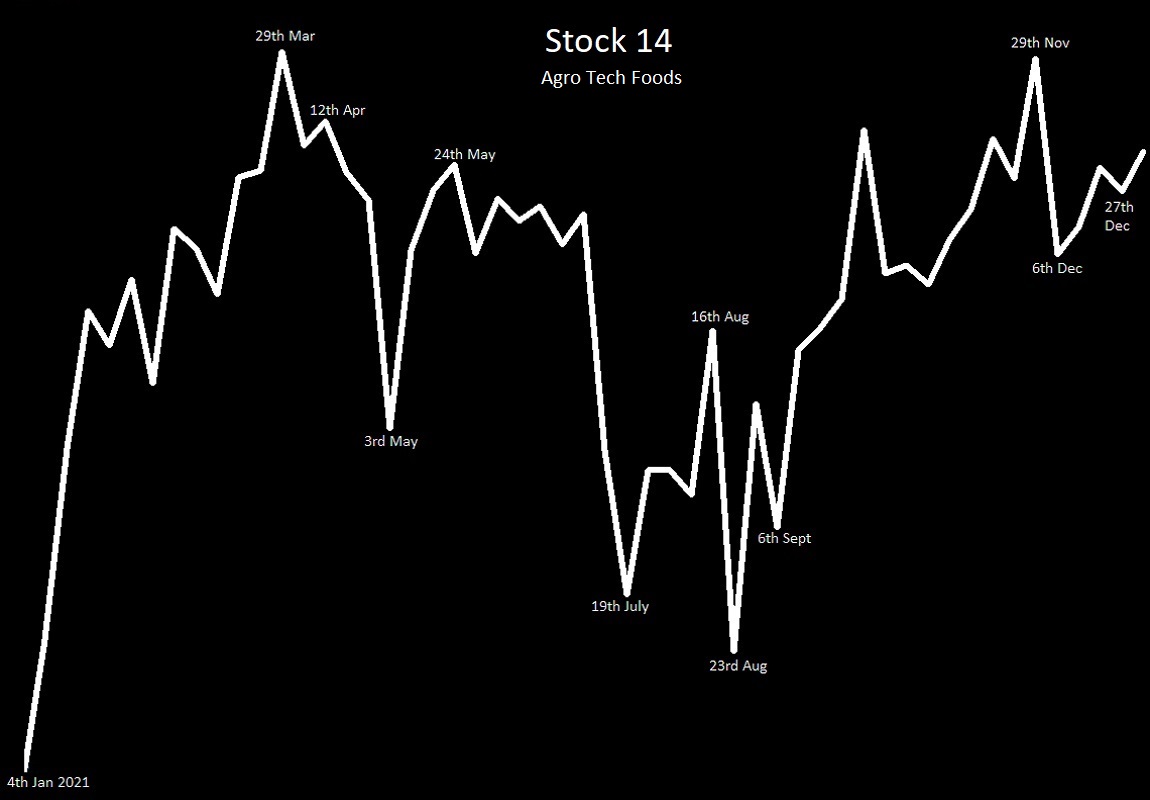

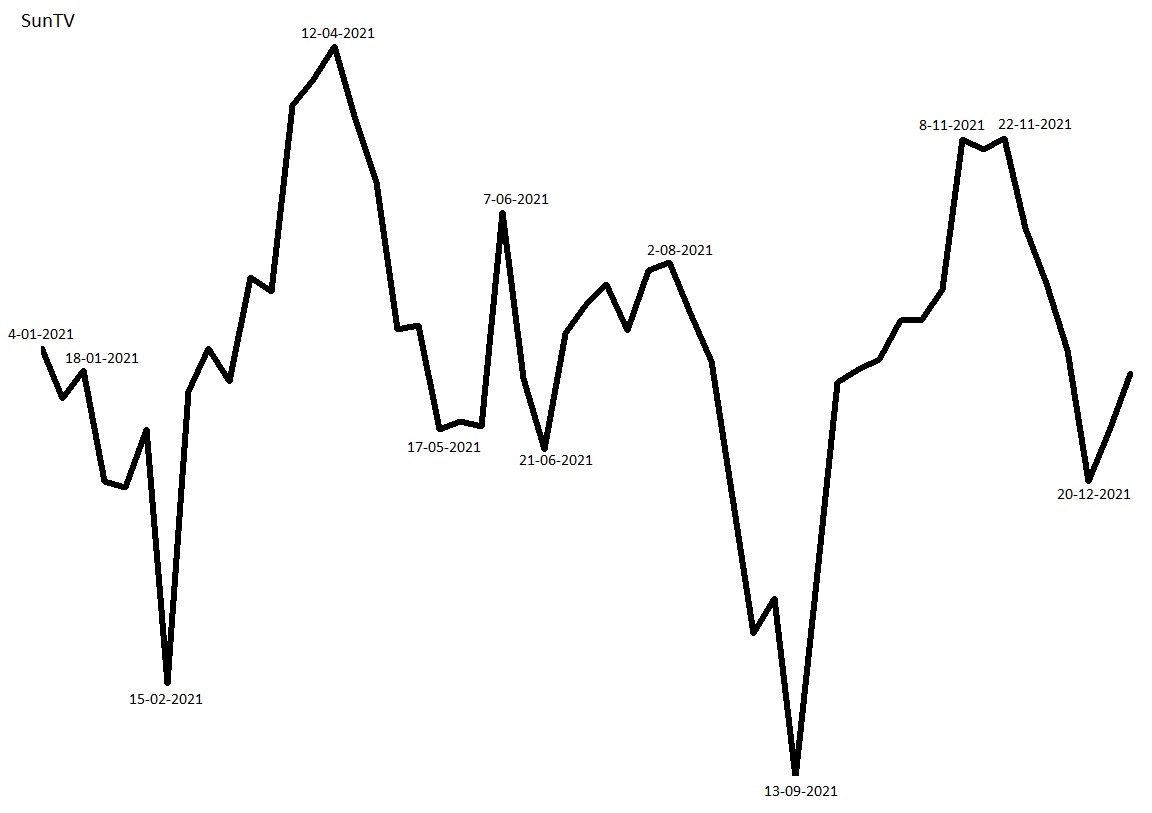

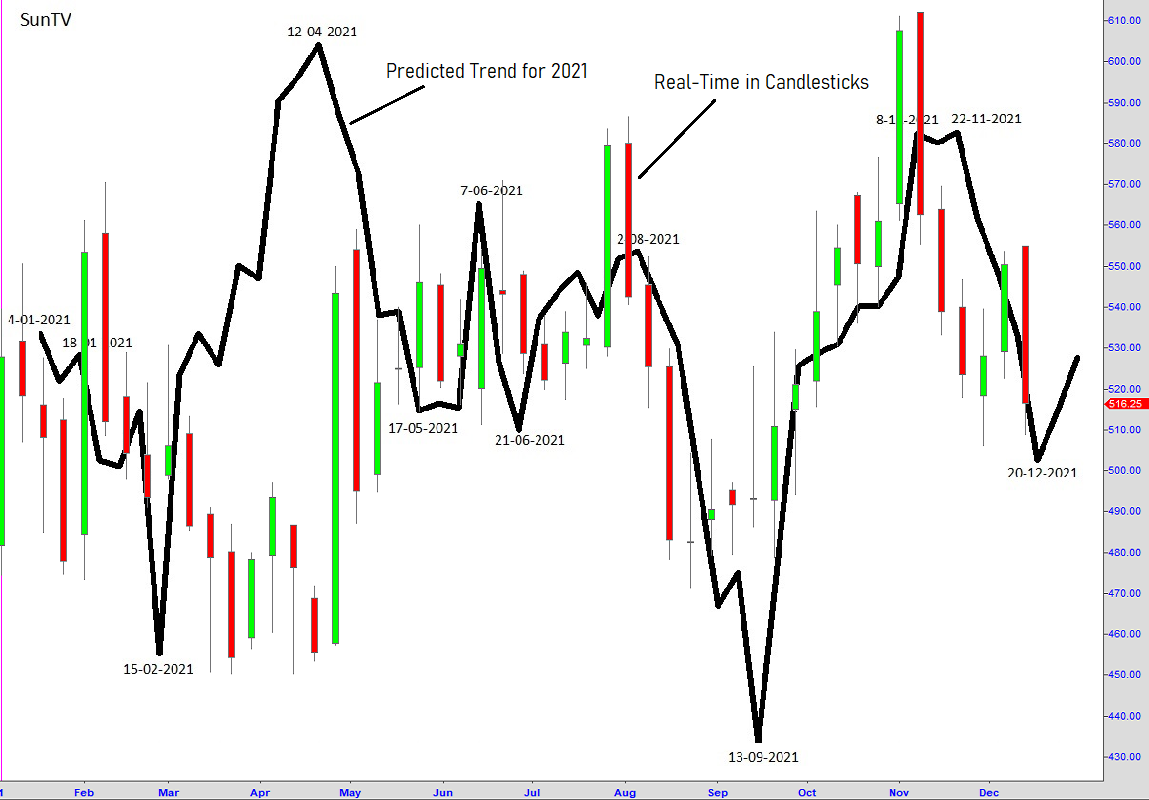

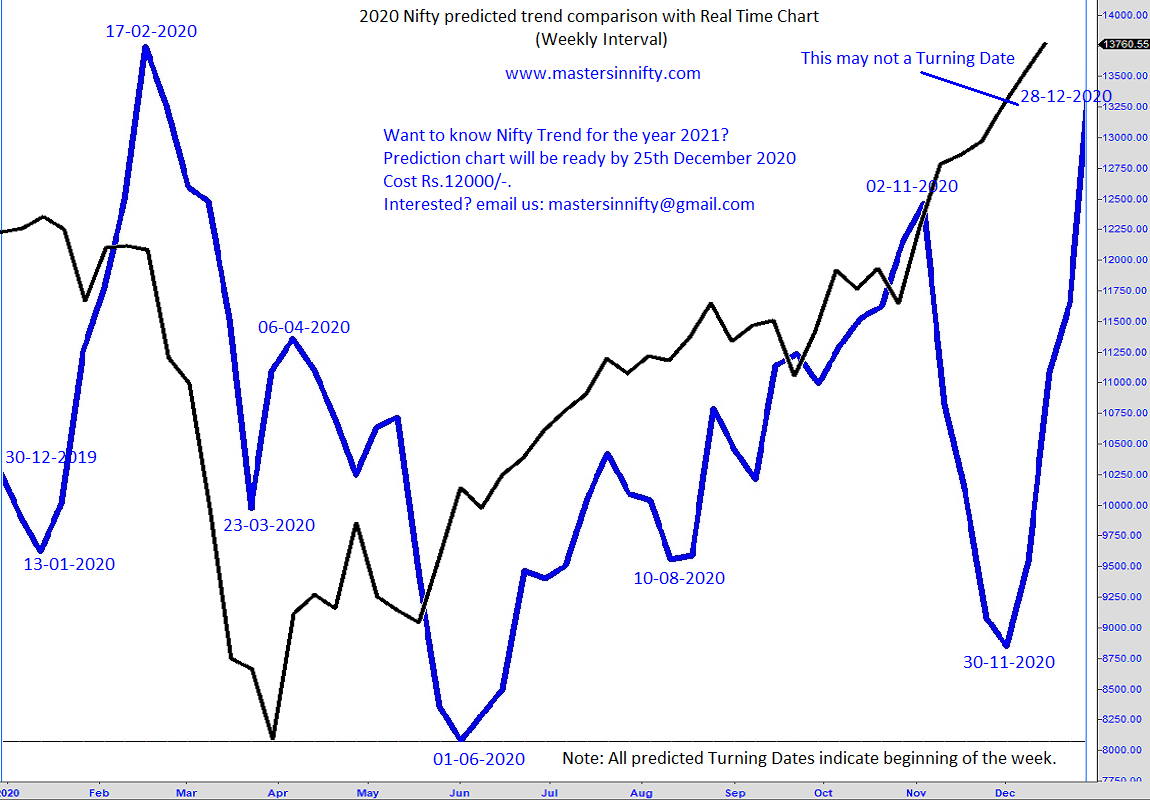

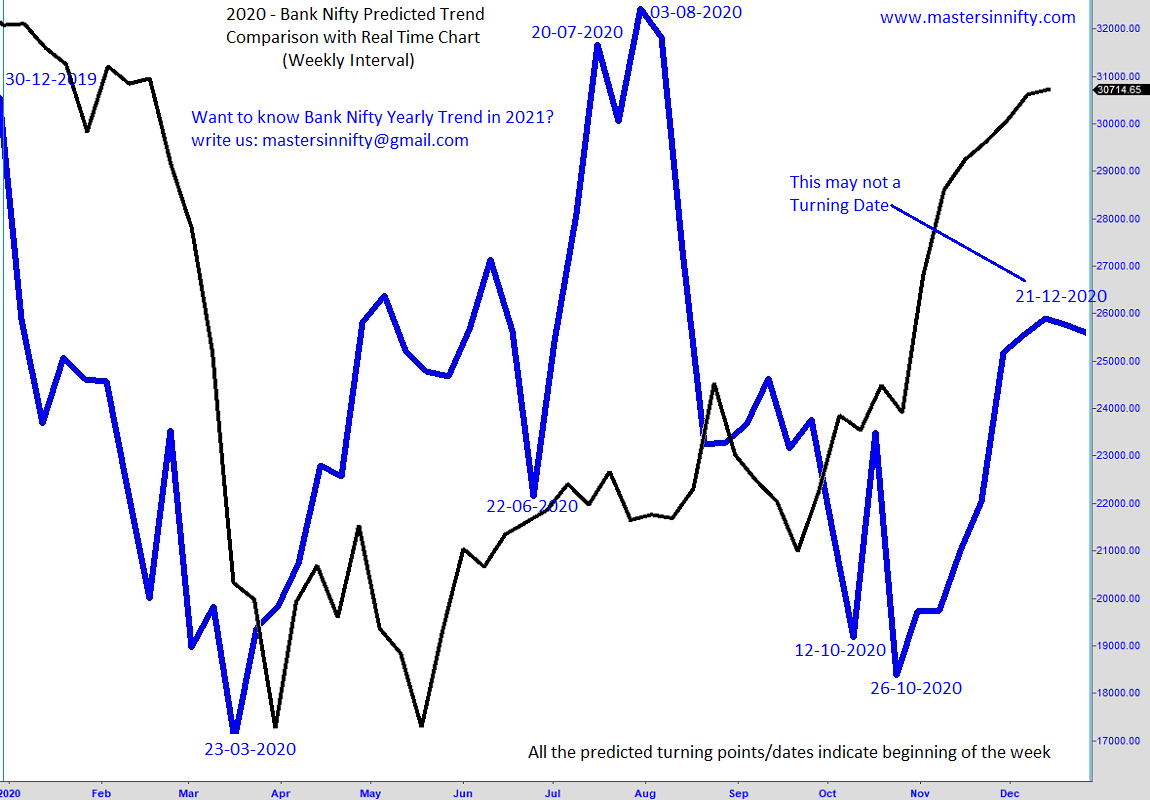

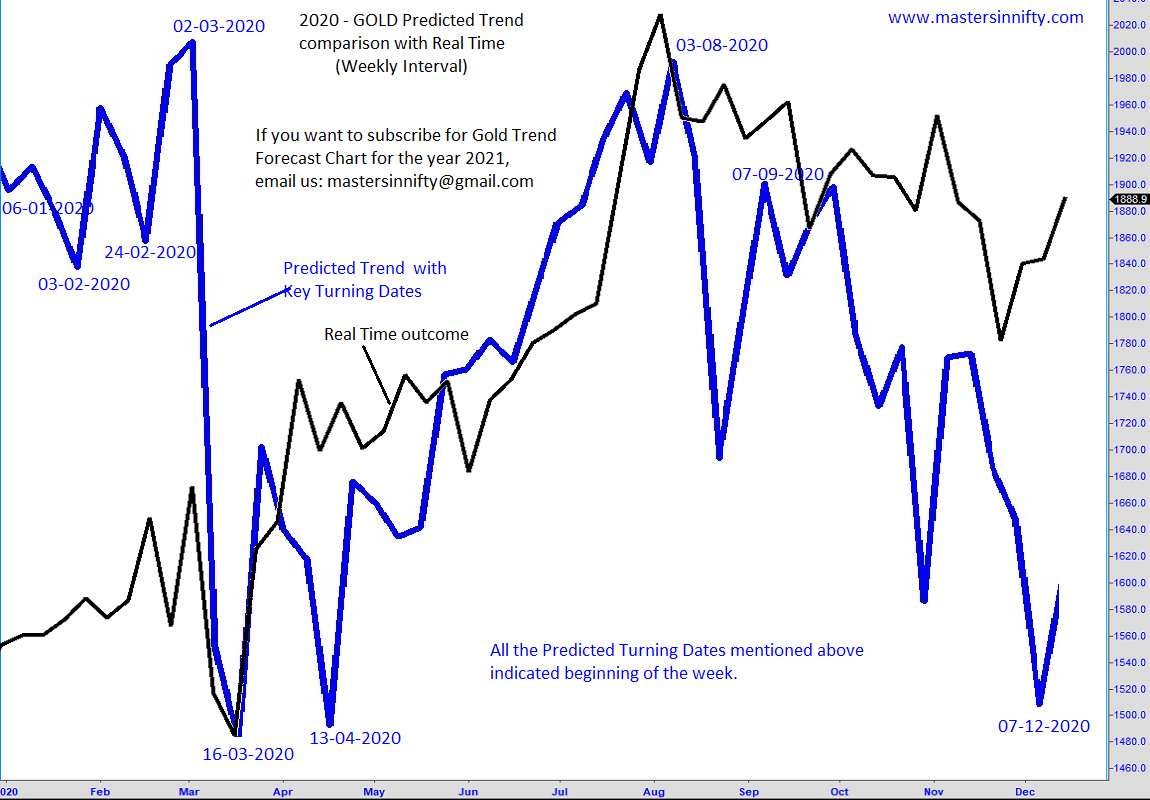

To support our mutual fund clients, we provide an Annual Advance Market Forecast Chart in the last week of December each year, based on our specialized dynamic market cycle analysis using various mathematical tools. These prediction charts offer investors a roadmap for the upcoming year, including entry and exit dates, as well as major market opportunities and threats. This informed approach helps our clients make strategic investment decisions and optimize their returns.

Please take a look at the yearly forecast maps provided at the bottom of the page, which we have prepared well in advance.