"0+1=1"

This platform offers technically analyzed forecasts for a range of financial markets, including Nifty, Global Markets, FOREX, COMEX, Cryptocurrencies, and more. It is imperative to note that the content provided herein is strictly for informational and educational purposes. The information presented should not be construed as a recommendation to engage in buying or selling activities, and it may not be entirely accurate.

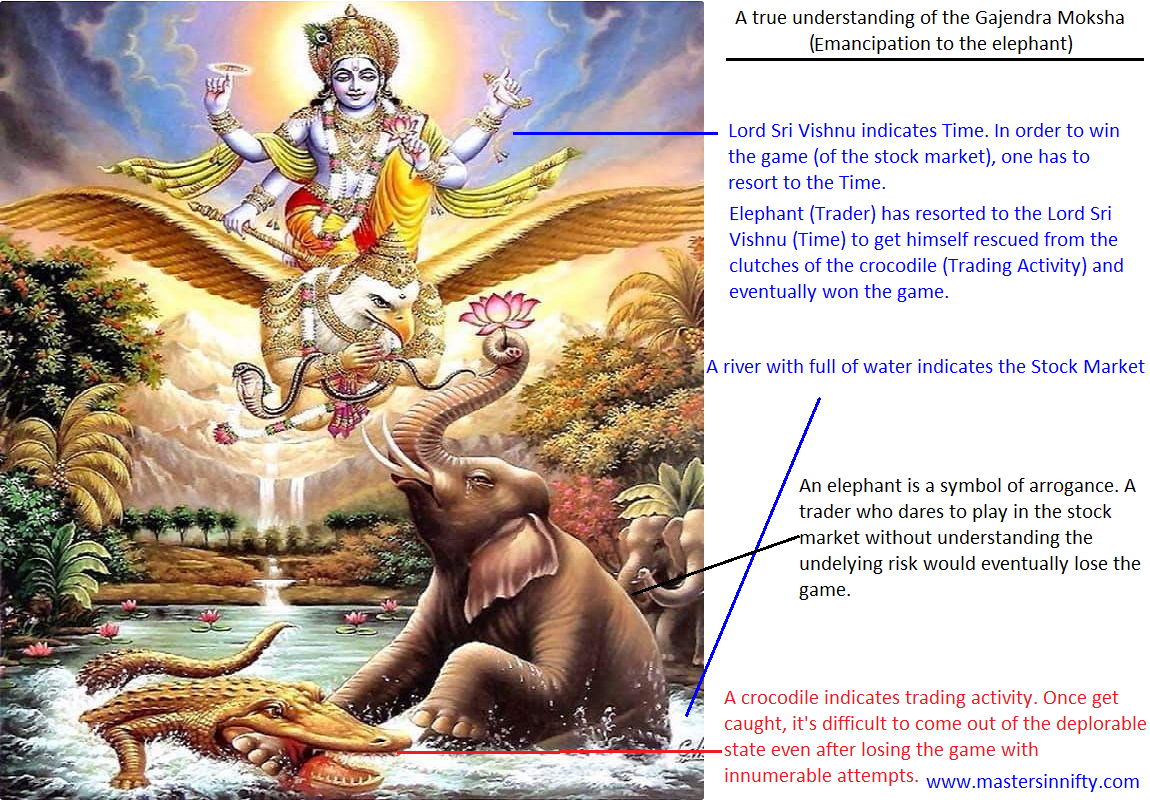

For individuals with a long-term investment horizon of 7+ years, particularly those invested in direct equity or mutual funds, short-term market fluctuations should not be a cause for concern. We strongly advise against engaging in aggressive and unplanned trading activities, as such actions demand profound knowledge and comprehensive analysis from professionals who are adept at managing funds.

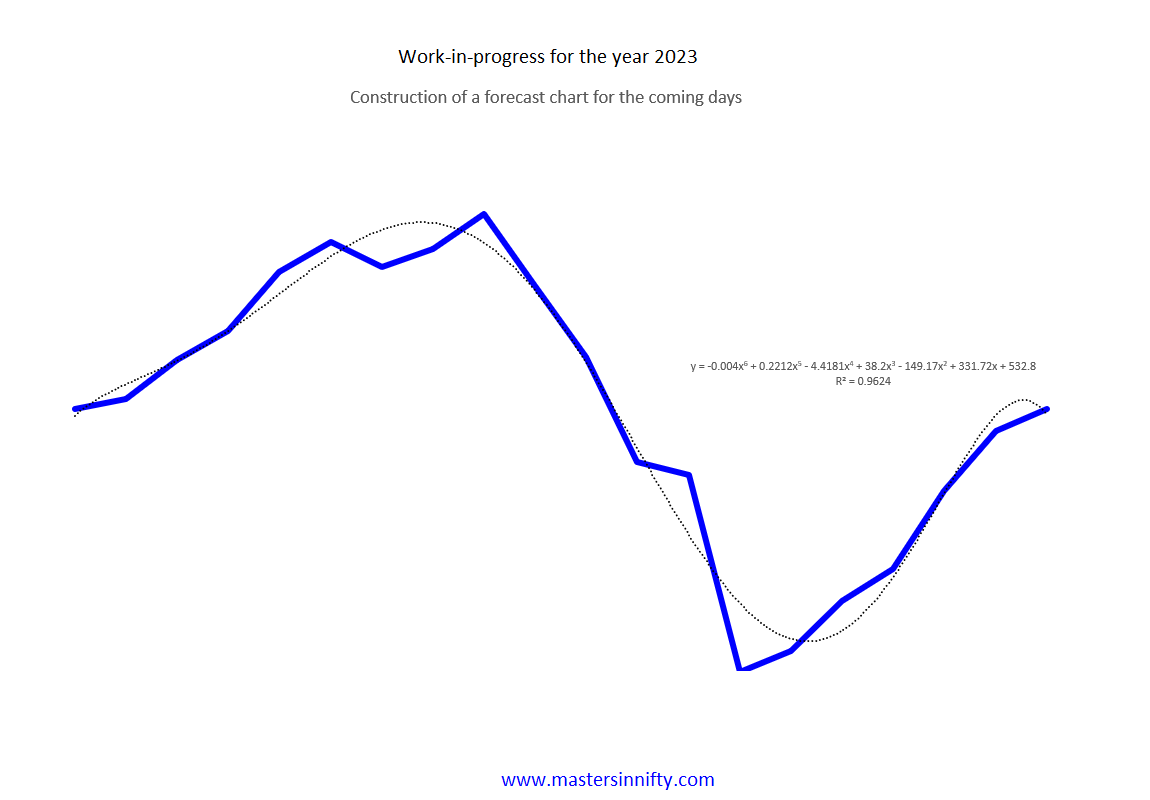

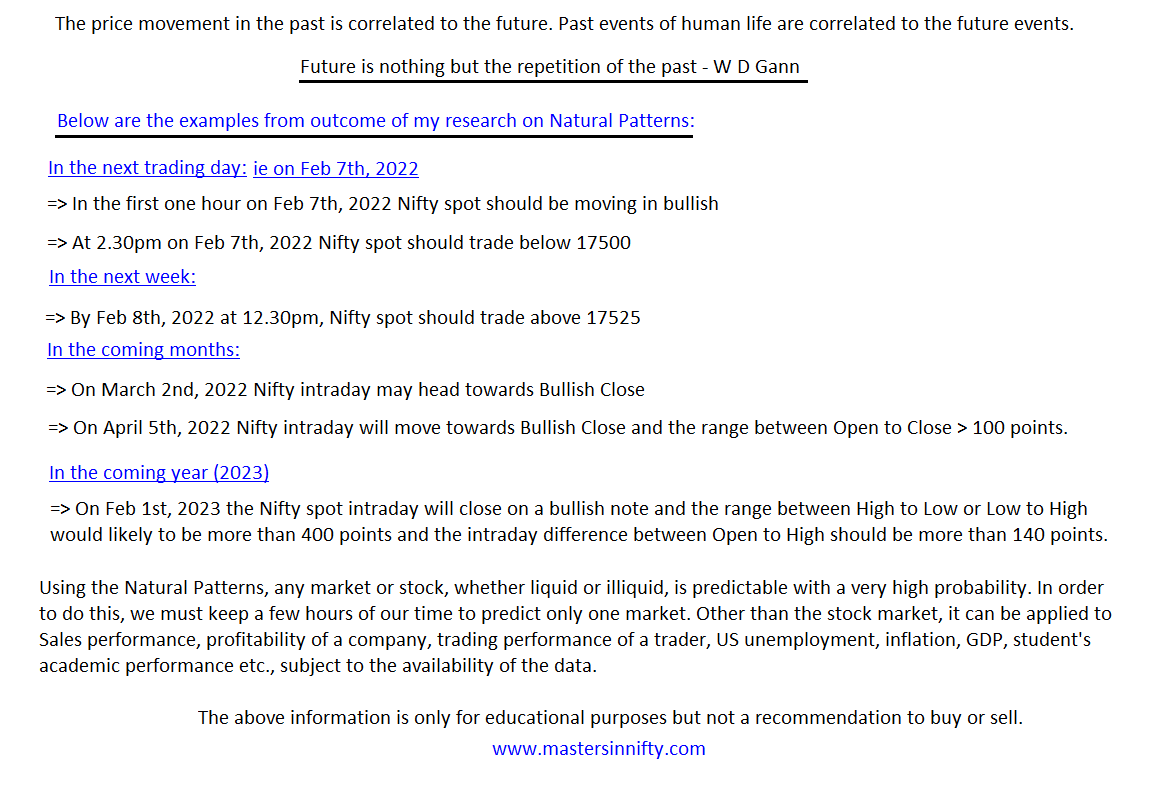

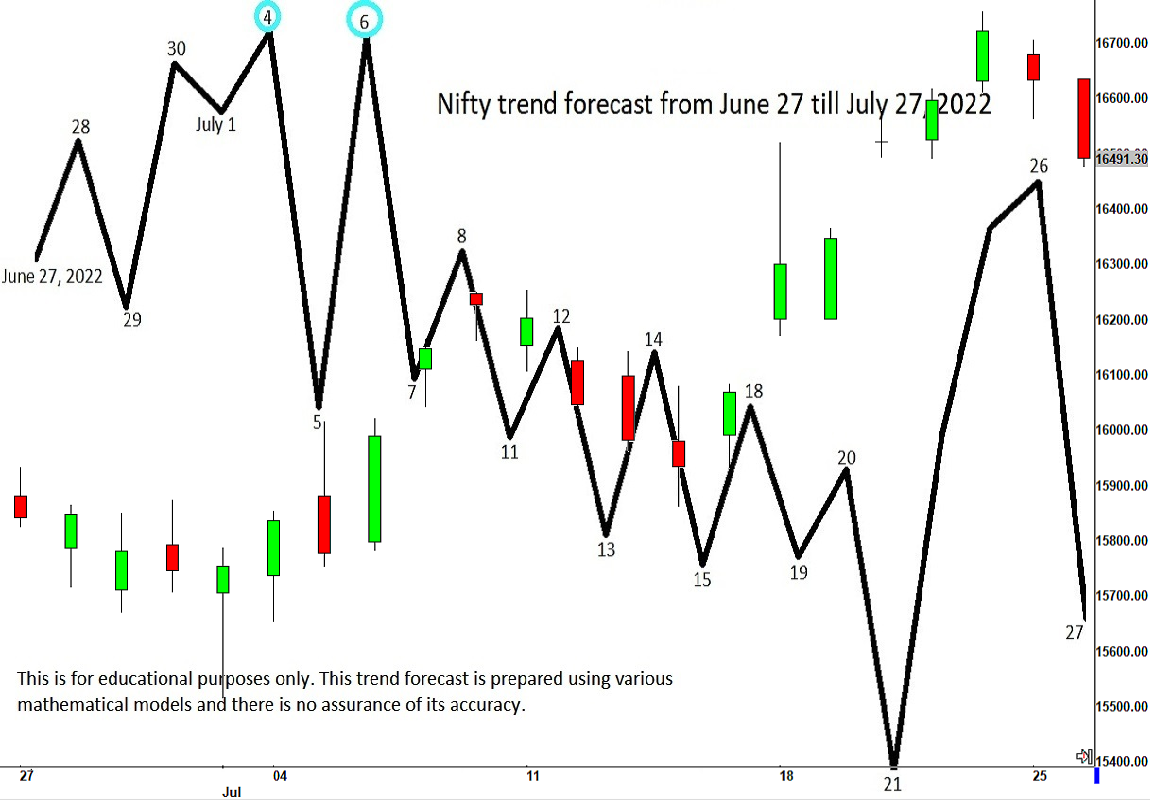

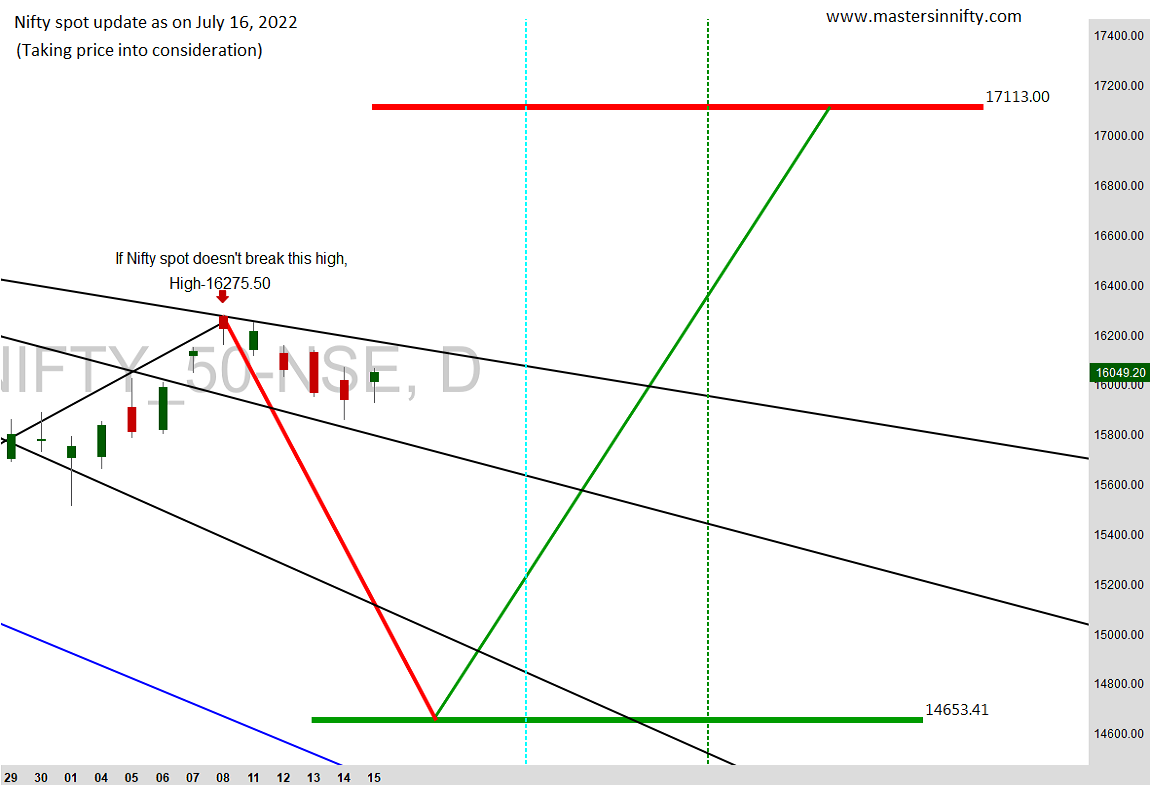

For the first time in the trading realm, we are unveiling comprehensive cycles and patterns, offering traders an overarching perspective on market trends for Nifty and other stocks. This unique approach provides a distinct advantage over existing trading forecast methodologies worldwide.

- Do you want to look at our Nifty or Bank Nifty intraday predicted movements in advance? Click here

The Nifty and the global markets outlook for the week April 21-25, 2025

- The Nifty is Bullish for the week. The Nifty High-Low range may cross 700 points during the week.

- The S&P 500 Index is Bullish for the week.

- XAUUSD (GOLD) is Bullish

- INR is weak against the USD

- The US Stock "NVIDIA" is bullish for the week.

- Updated on April 19, 2025, at 9:39 pm.

Recommended Books for Trading Principles & Discipline

-

Best Book for Trading Principles & Discipline:

- Srimad Bhagavad Gita (Example: Chapter 2, Verse 47, 62 & 63 Chapter 16, Verses 21 & 22)

-

My Trading Bible:

- Technical Analysis of the Financial Markets – John J. Murphy

-

Best Book by W.D. Gann:

- Tunnel Through the Air or Looking Back from 1940 – W.D. Gann

-

Best Book on Cycle Analysis:

- The Profit Magic of Stock Transaction Timing – J.M. Hurst

-

Best Book on Candlestick Analysis:

- Candlestick Charting Explained – Gregory L. Morris (Still my go-to reference)

-

Other Notable Trading Books:

- Day Trading – Joe Ross

- The Delta Phenomenon – Welles Wilder

- Reading Price Charts Bar by Bar – Al Brooks

- Money-Making Candlestick Patterns – Steve Palmquist

- Fibonacci Trading – Carolyn Boroden

Trading Advice: Avoid Unnecessary Expenses

- No Holy Grail: Avoid spending on books or software that claim to guarantee trading success.

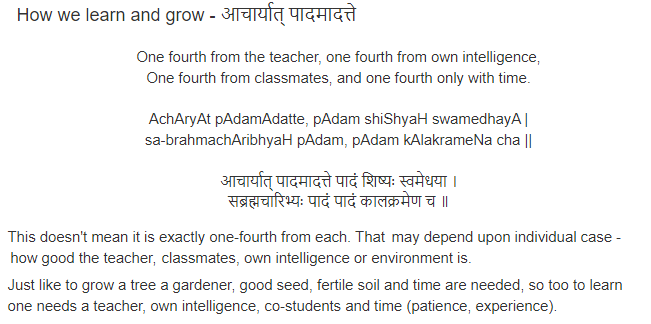

- Self-Reliance: True success comes from applying and refining your ideas through experience.

- Consistent Practice: Mastery requires continuous effort and discipline.

- Timeframe for Success: Achieving your trading goals can take months or even years depending on your analytical skills.